Market Commentary

Stocks and bonds began the week on a strong note as investors reacted positively to Donald Trump’s nomination for Treasury Secretary, Scott Bessent. The hedge fund manager’s appointment is widely seen as a signal of moderation in some of Trump’s more contentious policy proposals, such as imposing steep tariffs. This optimism drove bond yields lower, with the 10-Year Treasury yield dropping from 4.4% to 4.28%.

Meanwhile, the S&P 500 is pushing toward the significant 6,000 milestone but has yet to break through. Despite this, the index is on track for its sixth consecutive day of gains. Underneath the headline numbers, the market continues to broaden out, a trend we’ve observed over the past few weeks. Notably, Small-cap stocks are beginning to meaningfully outperform their larger-cap counterparts.

Oil prices declined this week following reports that Israel and Lebanon have reached an agreement to end the Israel-Hezbollah conflict. According to U.S. officials, Israel’s Security Cabinet is expected to approve the deal as early as tomorrow. This drop in oil prices comes on the heels of one of the largest weekly gains in recent months, which was triggered by heightened geopolitical tensions after Russia launched a hypersonic missile at Ukraine.

With the Thanksgiving holiday approaching, economic data releases are relatively light this week. However, two key reports will capture investor attention: the minutes from the Federal Reserve’s November FOMC meeting, set for release tomorrow, and the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, coming Wednesday. These updates will provide critical insights into the Fed’s potential policy trajectory, particularly as the economy shows resilience and a new administration signals tax cuts and tariffs.

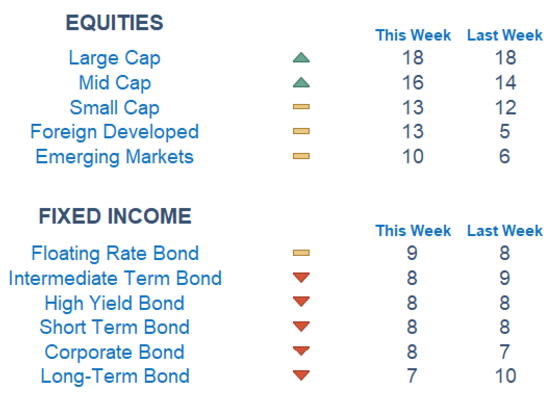

Our Newton models indicate continued strength in the markets, with scores showing slight improvements across the board compared to last week. Domestically, U.S. markets remain ahead of their international counterparts, although some mean reversion is evident in foreign markets bouncing off recent lows. Fixed Income continues to struggle, however with the moves today, we would expect some improvement across the curve. Sector-wise, Health Care remains an underperformed. Technology, Communications, and Real Estate make up the top 3 areas.

Economic Releases This Week

Monday: None

Tuesday: S&P Case-Shiller Home Price Index, Consumer Confidence, New Home Sales, Minutes of Fed’s Nov FOMC Meeting

Wednesday: PCE Index, GDP (1st Revision), Durable Goods

Thursday: None, Thanksgiving Holiday

Friday: None

Stories to Start the Week

Macy’s delays its earnings release as it says an employee hid up to $154 million in delivery expenses.

Bitcoin’s march to $100,000 stalls.

Mango, the privately held Spanish retailer, is in the middle of opening new stores in the U.S. as part of a broad expansion plan.

The box office was a popular destination over the weekend with Wicked opening at $114 million and Gladiator $55.5 million.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.