MARKET COMMENTARY

Markets started the week on a positive note, lifted by strong early earnings results and signs that tensions between the US and China may be easing. While trade headlines remain in focus with President Trump’s August 1st tariff deadline still looming, investors are largely turning their attention to second quarter earnings. Major companies like Tesla and Alphabet are set to report midweek, and early results from firms like Domino’s and Verizon suggest consumer spending remains resilient. This follows last week’s encouraging retail sales data, reinforcing the idea that the US consumer continues to support the economy.

Inflation remains a key theme, with recent data showing that prices are rising faster in areas sensitive to tariffs, such as apparel, furniture, and appliances, even though the headline numbers remain relatively contained. The Federal Reserve is watching these trends closely and appears to be in wait and see mode before making any rate decisions. Bond yields have pulled back, helping to support equities even as inflation and policy uncertainty remain in play.

Abroad, political developments in Japan and upcoming central bank decisions in Europe could influence currency and trade dynamics, especially as global policymakers respond to US tariff moves. Meanwhile, market participation remains broad, with over 60% of S&P 500 companies trading above key moving averages. That breadth helps provide a stronger foundation for the rally. However, earnings growth continues to be concentrated among a few mega cap tech names, and that narrow leadership could pose a risk if sentiment shifts.

Newton Model Insights:

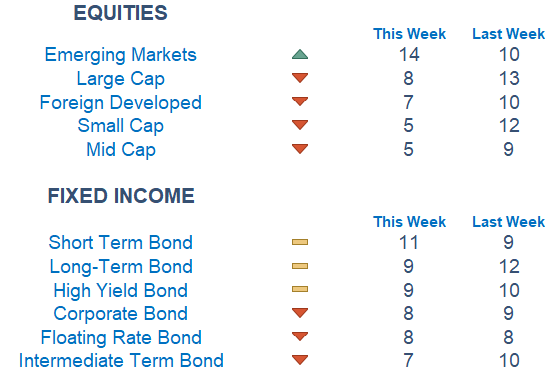

According to our Newton Model, large-cap growth has taken the lead, though it’s worth noting that all equity styles have seen a notable decline in relative strength over the past week. Emerging markets have outperformed developed markets, benefiting from improving momentum, while most other regions are losing ground amid continued valuation concerns.

Sector trends tell a similar story of broad-based softness. Industrials and utilities are showing relative resilience, but the majority of sectors have weakened. On the fixed income side, short-term bonds currently offer the most attractive risk-reward profile. Meanwhile, floating-rate and corporate bonds have seen a deterioration in trend, suggesting growing caution among investors.s and high yield have taken the lead, though the asset class remains broadly under pressure.

Economic Releases This Week

Monday: US Leading Economic Indicators

Tuesday: Fed Chair Powell Opening Remarks at Banking Conference

Wednesday: Existing Home Sales

Thursday: Initial Jobless Claims, S&P Flash US Services PMI, S&P Flash US Manufacturing PMI, New Home Sales

Friday: Durable Goods Orders

Stories to Start the Week

After Pledging to Keep Prices Low, Amazon Hiked Them on Hundreds of Essentials

Microsoft Hit With SharePoint Attack Affecting Global Businesses and Government

Southwest Airlines Sets a Date for Seat Assignment Launch, Lays Out New Boarding Order

Goldman Sachs to Launch Private Credit Product for Retirement Plans

London Stock Exchange Group Weighs 24-Hour Trading, FT Says

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.