Market Commentary

Equity markets started the week on a cooler note, as rising geopolitical tensions weighed down sentiment. While there were encouraging signs from China, the volatile global landscape, marked by the end of Bashar al-Assad’s regime in Syria and South Korea’s ongoing political impasse, kept investors cautious.

Outside of the geopolitical landscape, investors will be watching global central banks as the European Central Bank is meeting for the first time since the collapse of governments in France and Germany. They are expected to cut rates alongside the Bank of Canada and Swiss National Bank.

Domestically, eyes are on the Federal Reserve, which meets on December 18th and is widely expected to cut rates by another 25 basis points. Recent labor market data has been balanced—not too strong, not too weak—providing the Fed with room to make the anticipated cut. However, this week’s key inflation reports could influence the outlook; a hotter-than-expected read might reduce the odds of a rate cut, though that scenario seems unlikely.

The Consumer Price Index (CPI) is projected to rise slightly to 2.7% year-over-year, up from last month’s 2.6%. Given these elevated inflation levels and a labor market that remains relatively stable, the Fed is likely to signal a more restrained approach to further cuts in 2025. Moving into early next year, we expect a more cautious monetary policy stance, with the Fed turning more attention to persistent inflationary pressures with the strength in the labor market.

Stocks have pushed past and held the 6,000 level recently with many strategists calling for another leg higher in 2025. We will be watching how much the broadening continues and if earnings growth can support current lofty valuations. Expectations call for a 17% YoY increase in S&P 500 earnings next year.

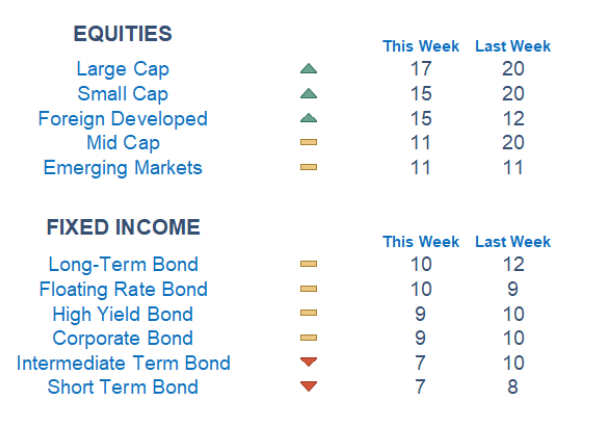

Our Newton models suggest a slight decline in momentum, though US markets continue to show strength, particularly in large-cap and growth segments. Fixed income remains under pressure despite a recent modest pullback in yields. Sector performance trends remain consistent, with technology, communications, and consumer discretionary leading the pack, while utilities, health care, and materials lag behind as the weakest areas.

Our Newton models indicate continued strength in the markets, with scores showing slight improvements across the board compared to last week. Domestically, U.S. markets remain ahead of their international counterparts, although some mean reversion is evident in foreign markets bouncing off recent lows. Fixed Income continues to struggle, however with the moves today, we would expect some improvement across the curve. Sector-wise, Health Care remains an underperformed. Technology, Communications, and Real Estate make up the top 3 areas.

Economic Releases This Week

Monday: Wholesale Inventories

Tuesday: NFIB Optimism Index, US Productivity (Revision)

Wednesday: Consumer Price Index (CPI), Monthly US Federal Budget

Thursday: Initial Jobless Claims, Producer Price Index

Friday: Import Price Index

Stories to Start the Week

Donald Trump said yesterday that he will not try to replace Federal Reserve Chair Jerome Powell upon taking office.

Ousted Syrian leader Bashar Assad fled to Moscow and received asylum from his longtime ally.

Juan Soto has signed the largest sports contract in history with his 15-year, $765 million deal.

A plan to impeach South Korean President Yoon Suk Yeol over his short-lived declaration of martial law has failed.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.