Market Commentary

U.S. equity markets are starting the shortened trading week on a steady note. The government shutdown drama has been avoided for now, with President Biden signing funding legislation to keep operations running until mid-March. Meanwhile, last Friday’s cooler-than-expected PCE index sparked some optimism about rate cuts in 2024, though the Fed’s hawkish tone and adjusted projections are keeping investors cautious.

Trading is expected to be quiet this week with limited economic data releases. The focus is on whether markets can work off their oversold conditions heading into the end of the year. The S&P 500 dropped below 6,000 last week after a volatile stretch but saw improved breadth on Friday. It remains to be seen if this bounce is the start of a recovery or just a brief reprieve after heavy selling pressure.

Many are hoping for a boost from the “Santa Claus rally,” the final five trading days of the year. Historically, this period has added an average of 1.3% to the S&P 500 since 1969. It all culminates to one theme: the mood is cautious, but there’s still potential for a strong finish to the year.

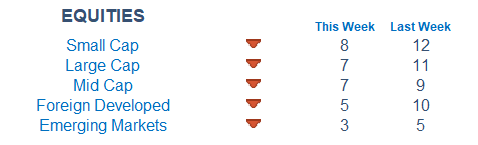

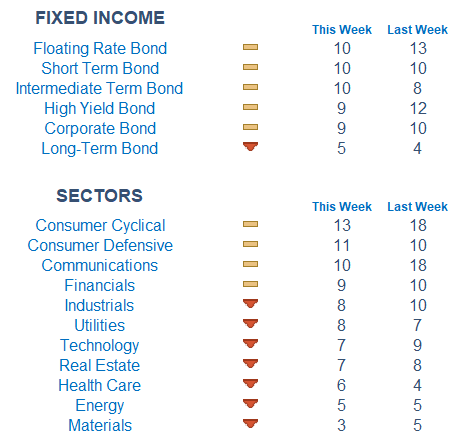

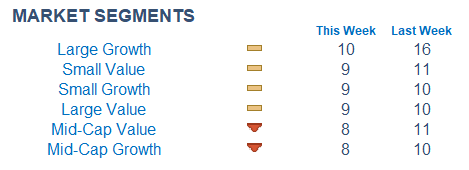

Our Newton models show a mixed bag, however, we are noticing many scores switch trend to the downside. This aligns with what we are seeing in markets as well. Large growth names are scored best while Foreign and Emerging markets are faring worse for yet another week. In fixed income, the long bond, which is highly sensitive to interest rate movements, continues to score the worst but is looking better recently.

Economic Releases This Week

Monday: Consumer Confidence

Tuesday: Durable Goods Orders, New Home Sales, Markets Close at 1PM EST

Wednesday: Christmas Holiday, Markets Closed

Thursday: Initial Jobless Claims

Friday: None

Stories to Start the Week

The best inventions of 2024.

The US launched a new probe into legacy Chinese chips as tech pressure on Beijing escalates.

Two weeks before Black Friday, Amazon quietly added a new section to the top of its mobile app. Haul is a mobile-only area for ultra-low-price items.

MacKenzie Scott donated $2 billion this year. She’s now given away $19 billion since 2019.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.