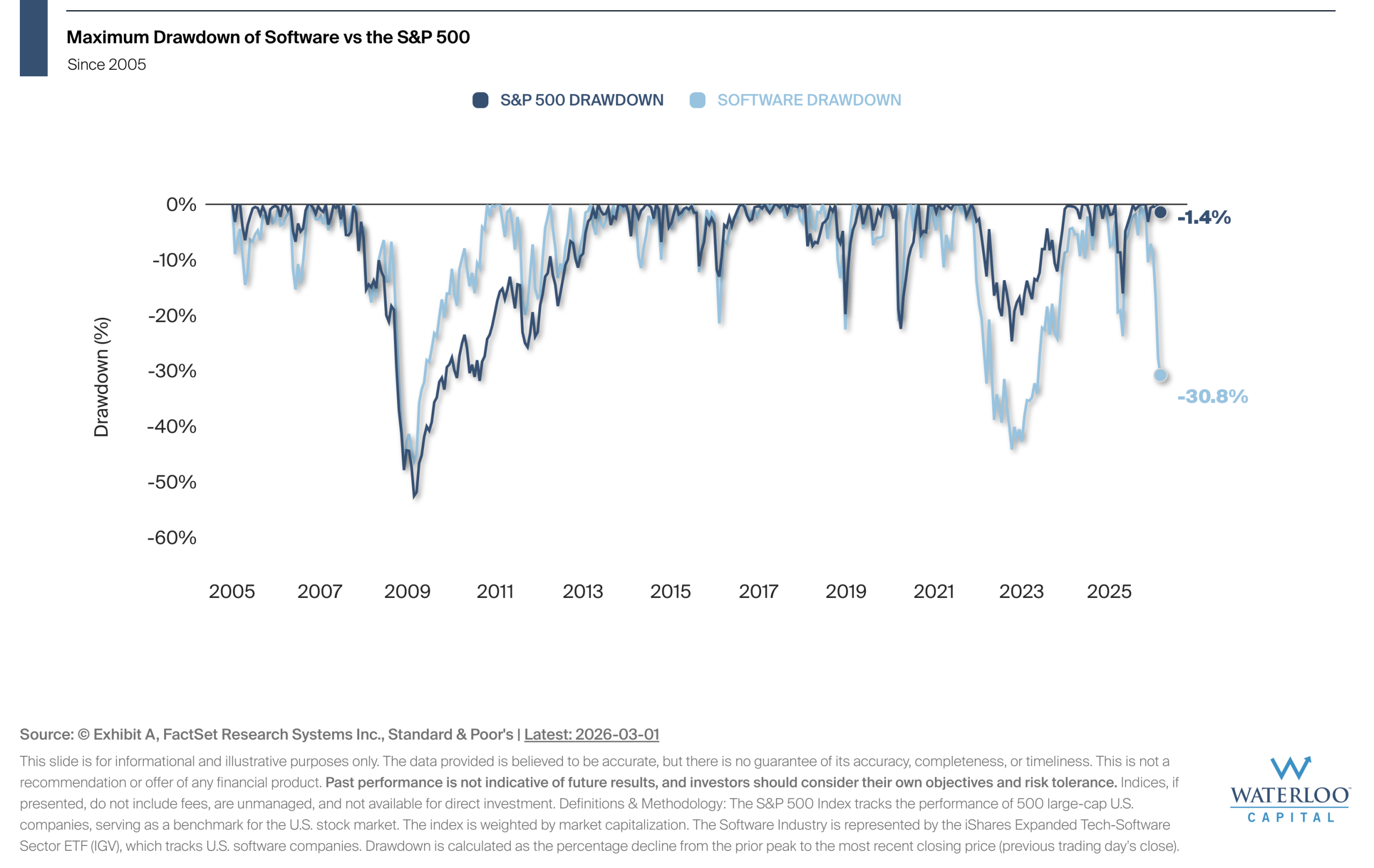

Chart Of the Week – Diversification At Work: Software vs The S&P 500

The chart illustrates the historical difference in drawdowns between the Software Industry and the S&P 500 Index[…]

This Week on Wall Street – Week of March 3rd

The U.S. and Israel’s coordinated strikes on Iran over the weekend, and Iran’s retaliatory attacks, have pushed geopolitics back to[…]

Last Week on Wall Street – February 28th, 2026

S&P 500: -0.44% DOW: -1.31% NASDAQ: -0.95% 10-YR Yield: 3.97%

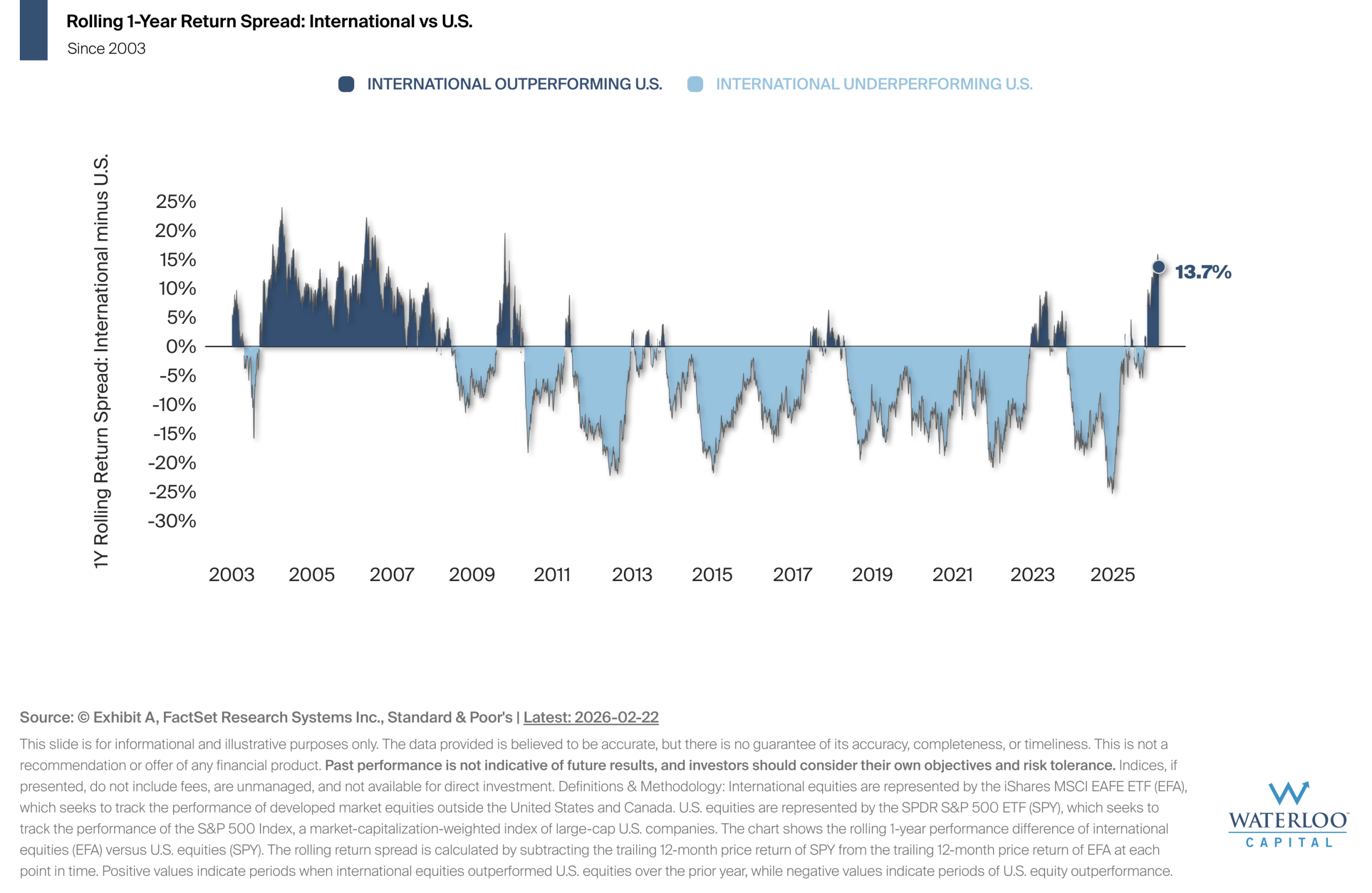

Chart Of the Week – Cycles of International vs U.S. Performance

The chart illustrates the rolling one year performance spread between international and U.S. equities since the early[…]

This Week on Wall Street – Week of February 23rd

Markets finally caught some relief at the end of last week, moving upward on Friday.

Last Week on Wall Street – February 21st, 2026

S&P 500: 1.07% DOW: 0.25% NASDAQ: 1.51% 10-YR Yield: 4.09%

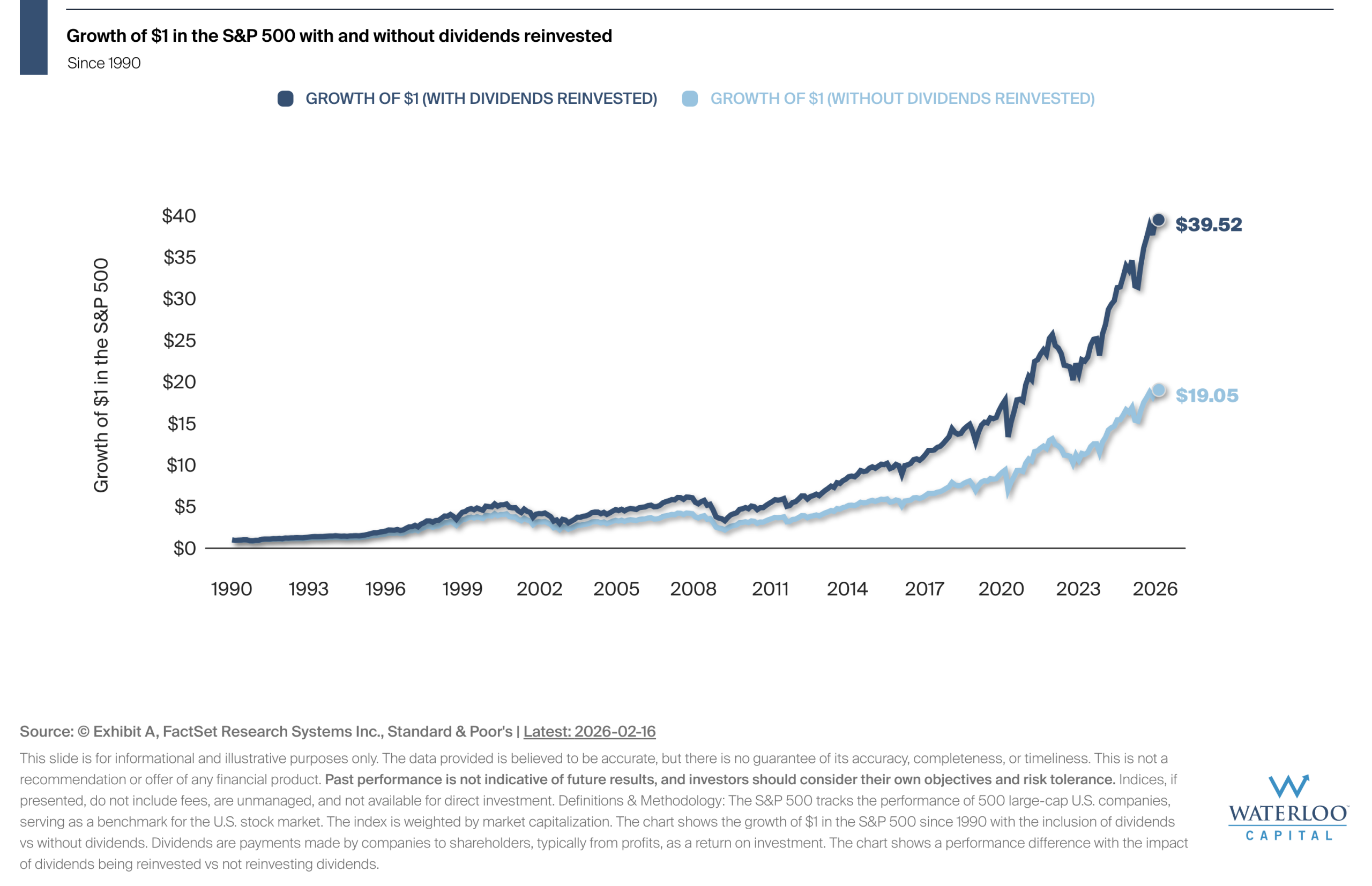

Chart Of the Week – The Importance of Dividends

The chart illustrates the power of dividends in driving long-term growth.

This Week on Wall Street – Week of February 17th

Last week, updates on the job market and inflation data signaled that the economy is moving toward[…]

Last Week on Wall Street – February 14th, 2026

S&P 500: -1.38% DOW: -1.23% NASDAQ: -2.10% 10-YR Yield: 4.05%

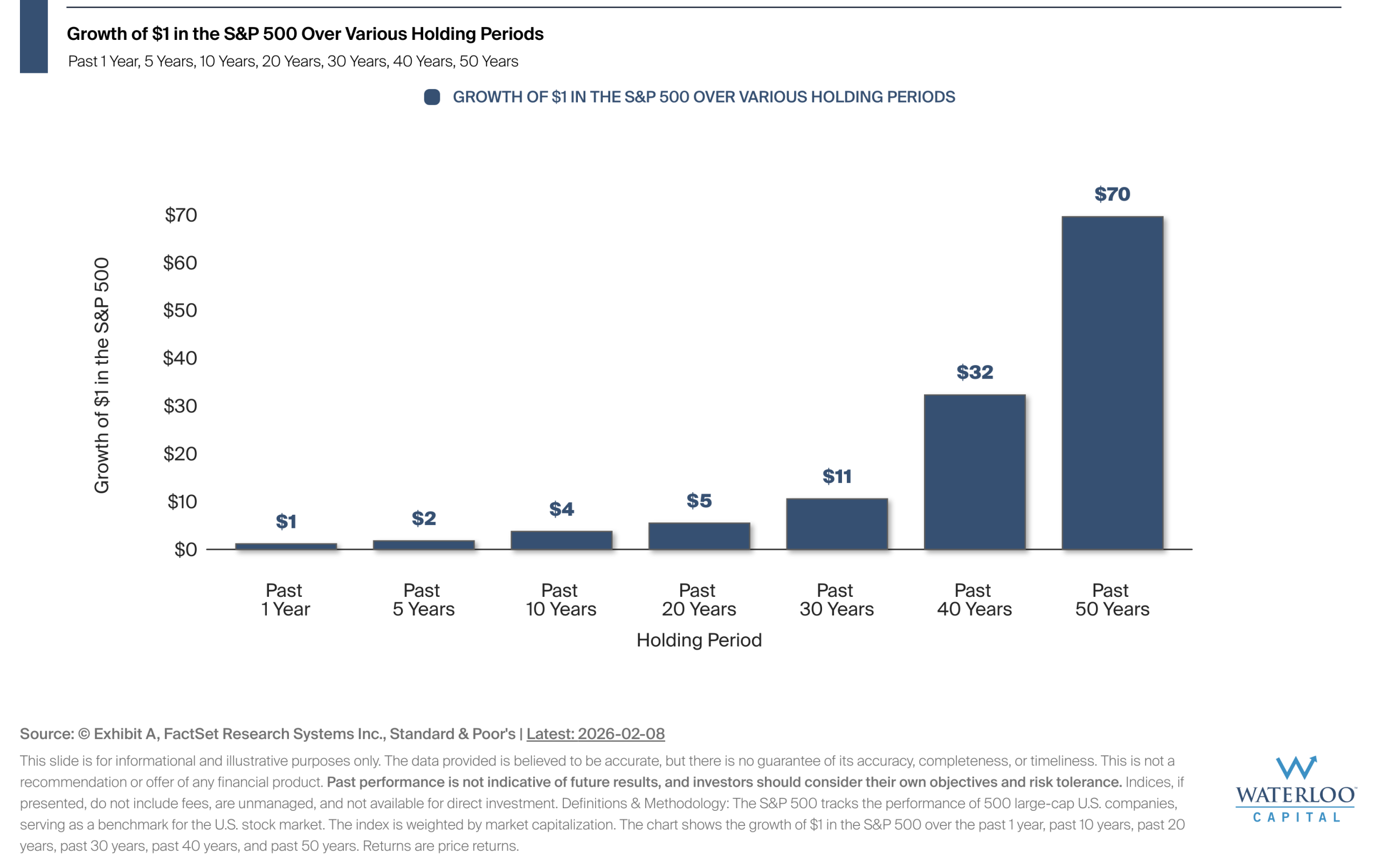

Chart Of the Week – The Impact Time Has Historically Had On Returns

S&P 500 growth patterns show how maintaining investments over decades has historically transformed modest contributions into substantial