Chart Source: Bloomberg

The 10-year Treasury yield and the U.S. Dollar Index (DXY) are more than just indicators of bond and currency markets. Due to their deep ties to macroeconomic conditions and government policy, they often reveal much more about the broader economic landscape than what meets the eye.

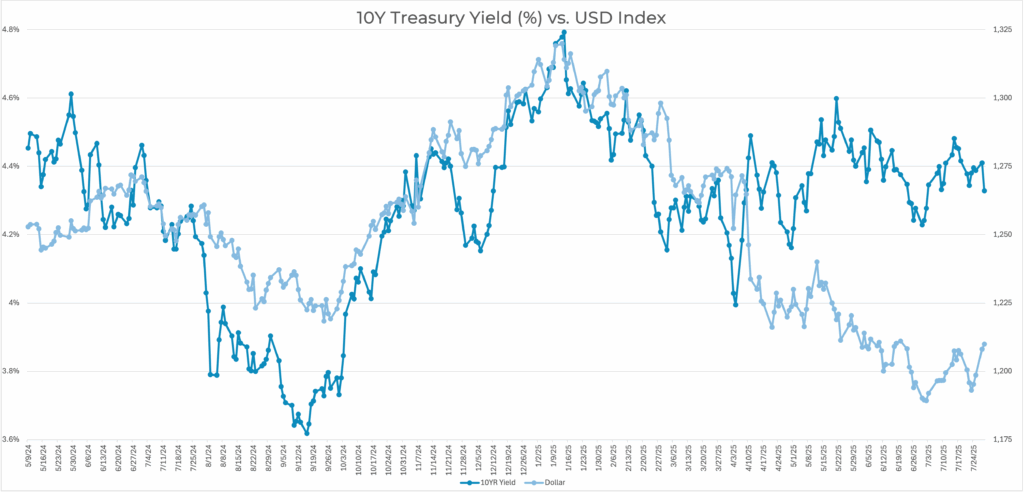

Historically, these two metrics tend to move in tandem. Higher yields typically attract foreign capital into U.S. government bonds, which increases demand for the dollar. But since early April, the chart shows a clear divergence: yields have climbed, while the USD Index has dropped sharply. So, what’s going on?

There are a few reasons:

- Major international investors diversified away from dollar assets amid U.S. trade policy uncertainty and geopolitical shifts. If they think U.S. policy is unpredictable, then demand for the dollar falls.

- With the U.S. national deficit expanding and debt levels at record highs investors are growing concerned about fiscal stress. As a result, they’re demanding higher yields in the form of term premium to compensate for the perceived risk of holding U.S. debt.

- At the same time this geopolitical uncertainty and shifting global alliances has, on the margin, made non-U.S. assets more attractive, leading to capital outflows from the dollar.

The recent divergence between U.S. Treasury yields and the U.S. dollar reflects a market recalibration driven less by growth or inflation expectations and more by concerns over political risk, fiscal credibility, and the perceived erosion of institutional independence. Rising yields, once a magnet for foreign capital and dollar strength, are now being interpreted through the lens of risk rather than reward.

If confidence is restored, through clearer fiscal discipline, reduced political interference, and more stable global relations – traditional yield-dollar dynamics could reassert themselves, particularly if U.S. growth remains solid. But if these pressures deepen, it may signal the start of a structural shift, one where the dollar loses some of its “exceptionalism” and foreign capital becomes less responsive to U.S. yields, regardless of their level.