Source: Kalshi, Bloomberg

As President Trump continues to express dissatisfaction with current Fed Chair Jerome Powell’s cautious stance on interest rate cuts, speculation is mounting over who will be nominated to lead the Federal Reserve next.

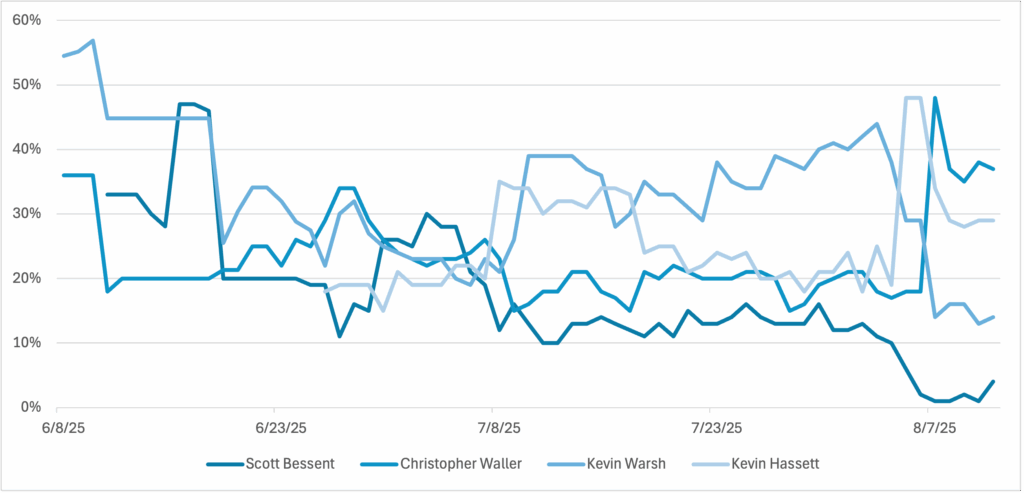

The odds for the next Fed chair have been on a wild ride, reflecting just how unsettled the selection process remains. No single candidate has managed to dominate for long as leadership has changed hands multiple times since June. This volatility is amplified by the fact that the decision-maker himself has an unpredictable communication style. President Trump’s public remarks on potential candidates have been far from linear, alternating between praise, criticism, and surprise mentions of new names.

The swings show a market trying to price in uncertainty in real time. While the Fed is designed to be perceived as independent, the political backdrop suggests all of these contenders may share one notable commonality: a dovish tilt favoring lower interest rates. This tilt should bolster long bonds, barring yields rising due to inflation concerns. A new Fed chair that is committed to lower rates should also buoy interest rate sensitive equities like real estate and small caps as long as economic growth holds. Markets began pricing in this scenario recently.

Here are the frontrunners:

Christopher Waller

Seen as the continuity pick, Waller is a current FOMC voting member. He has signaled alignment with Trump’s economic approach by dissenting from the Fed’s decision to keep rates steady. He argued that tariffs do not fuel inflation and emphasized the need for the central bank to focus on labor market stability. His position closely reflects Trump’s calls for steep rate cuts aimed at lowering debts and deficits and boosting economic growth.

Kevin Hassett

A close Trump ally and current Director of the White House National Economic Council. His trajectory from once advocating for Fed independence to criticizing Jerome Powell for perceived political motives signals a strategic realignment with Trump’s aggressive push for lower interest rates.

Kevin Warsh

Warsh was runner up when Trump appointed the last Fed Chair, Jerome Powell, in 2017. While he has recently shifted toward supporting rate cuts, his past criticism of expansionary policy and support for shrinking the Fed’s balance sheet means he is now leaning more towards a wildcard.

James Bullard

Bullard used to be the St. Louis Fed president a few years ago. He recently reappeared in the spotlight as a candidate for Fed chair, signaling a casting a wide net approach for Trump. The choice for Bullard also signals Trump favoring alignment of a putting more emphasis on growth than inflation.