MARKET COMMENTARY

Last Friday’s weak payrolls effectively cemented a Fed rate cut at the next meeting. The key debate now is whether policymakers opt for a modest 25bps move or a larger 50bps cut. While the smaller adjustment remains the more likely outcome, market pricing has started leaning toward the bigger option.

We’ll get more insight this week. On Tuesday, the nonfarm payrolls benchmark revision will be released, covering the 12 months through March. That update is expected to confirm what many have argued for some time: labor market conditions have been weaker than the headline data suggested.

Still, the case for a 50bps cut is constrained by the other half of the Fed’s dual mandate – inflation. August CPI arrives on Thursday and is expected to print near 3%, up from 2.7% previously. With inflation still running above target and showing a temporary uptick, an aggressive cut risks fueling looser conditions and renewed price pressures. Most likely, the Fed will opt for a balanced approach, opting for a 25bps cut to acknowledge labor market weakness, paired with cautious messaging that inflation remains uncomfortably high.

Equity markets remain near all-time highs and opened the week modestly higher. That said, September is typically a seasonally weak month, so investors should brace for elevated volatility. Outside of inflation data in the US, economic data is light.

Abroad, political developments are in focus. In Japan, Prime Minister Ishiba announced he will step down. While largely anticipated, investors are now weighing how much fiscal stimulus could follow his departure and whether this shifts the Bank of Japan’s approach to rate hikes. In France, Prime Minister Francois Bayrou’s government faces a likely collapse over his push to rein in the country’s massive debt burden. Should Bayrou lose the confidence vote, President Emmanuel Macron’s options would be to either appoint a new premier or dissolve the lower house and call early elections. Macron has been clear, however, that he has no intention of resigning.

Newton Model Insights:

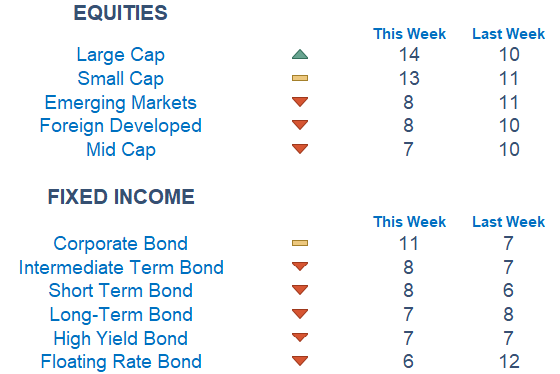

Our Newton Model readings suggest a US tilt compared to foreign equities. Megacap tech outperformed last week, which is being reflected in growth, leading the charge. Within sectors, communications and cyclicals are on top, while Real Estate, Defensives, and Health Care are laggards.

Economic Releases This Week

Monday: Consumer Credit

Tuesday: NFIB Optimism Index

Wednesday: Producer Price Index

Thursday: Initial jobless claims, Consumer Price Index

Friday: Consumer Sentiment

Stories to Start the Week

Alcaraz defeated Sinner at US Open.

Russia hit Ukraine’s captial with drone and missles yesterday in the largest aerial attack since the war began.

Federal and immigration agents conducted a raid on a Hyundai facility in Georgia last week, arresting 475 people.

SpaceX buys wireless spectrum from EchoStar in $17 billion deal.

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.