MARKET COMMENTARY

Jobs week is here and investors will get a flood of employment data, culminating Friday with the BLS’s first report under its newly appointed head. We’ve had endless discussions across markets from CNBC pundits to Fed Chair Powell himself, all adding up to show how critical the labor market is for the path of interest rate policy. Right now, the consensus expectation is for a continuation of a low-hiring, low-firing environment that hovers around the break-even rate (where jobs lost are replaced but no real gains are made). That may not sound thrilling, but with the unemployment rate sitting at 4.3% a stable labor market isn’t a bad outcome. We’ll also be watching revisions closely, especially after last month’s massive adjustments forced us to rethink the labor market’s strength.

The kicker? We might not even get the BLS data this week. A looming government shutdown could delay its release if Congress fails to reach a funding deal before tomorrow at midnight. Shutdown odds jumped after Trump canceled a negotiation meeting between the parties last week, pushing betting markets to price a 77% chance of a shutdown by year-end. If it happens, non-essential federal employees would be furloughed. That not only leaves investors flying blind on critical data but also weighs directly on the economy. With the government unable to consume goods and services, overall output takes a hit. Deutsche Bank estimates GDP growth could be depressed by 0.2% per week of shutdown. While shutdowns have historically been short-lived, the near-term consequences are still very real.

Overall, the bull trend in markets looks intact. Momentum remains strong, with a large share of stocks in positive uptrends and relatively few in sustained downtrends. Low volatility and a steady stream of new highs add to the technical optimism. That said, there are areas for the bears to point to for an impeding correction. Equities have pushed into overbought territory ,though last week’s slightly negative performance helped out a bit, and breadth is showing some softening.

Newton Model Insights:

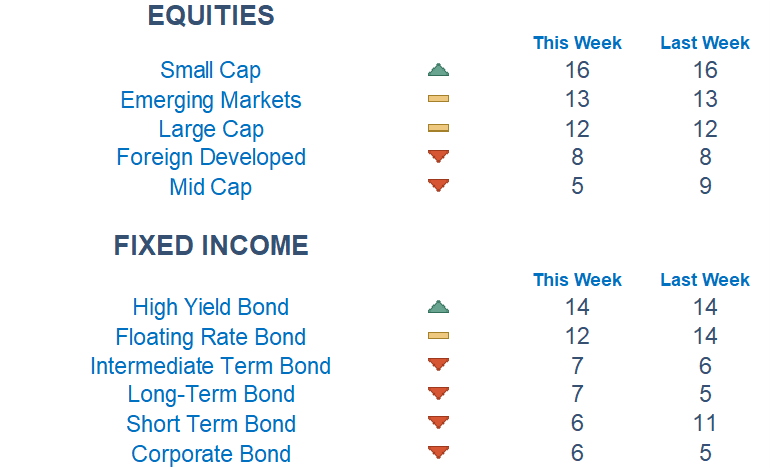

Our Newton model shows little change in market segment preferences after last week’s mostly neutralizing price action. Small caps continued to show momentum, while emerging markets and large caps also showed some improvement. Sector moves stood out more. Utilities and energy attracted buying pressure and climbed the rankings. Defensives, however, lagged and now sit at the bottom with the lowest possible score.

Economic Releases This Week

Monday: None

Tuesday: Job openings, Consumer Confidence

Wednesday: ADP Employment, S&P Manufacturing PMI, ISM Manufacturing

Thursday: Initial Jobless Claims

Friday: US Employment Report, S&P Services PMI, ISM Services

Stories to Start the Week

Electronic Arts is expected to go private in a $50 billion transaction, making it the largest leveraged buyout in history

Despite a nail biting rally from the USA team, Europe won the Ryder Cup on American soil yesterday for the first time in over a decade

A government shutdown is once again on the table this week, with President Trump threatening mass firings if a deal is not reached

Fifty-eight million pounds of corn dogs were recalled because they may contain pieces of wood, according to the USDA

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.