MARKET COMMENTARY

Into Fed week we go with markets stuck in a familiar cycle. This year, traders have debated the timing of the next rate cut only to see economic data or Fed commentary push expectations further out. On Wednesday, markets are finally set to get what they’ve been waiting for: the first 25 basis point cut in the resumption of this easing cycle. Market pricing indicated its a done deal and there’s even a small chance of a jumbo 50 basis point move priced. The data on hand gives the Fed enough ammo to justify the smaller cut, as employment data and revisions highlight a labor market losing some strength.

Despite receiving the initial cut market have been anticipating for all year, this story will remain a complicated one which is sure to be voiced in Chair Powell’s presser following the decision. With this rate cut a near certainty, its the rest of the rate cut schedule traders have baked into markets that investors will be listening to Powell’s comments for hints to. Last week’s CPI report was in line with expectations but still showed a risk of a uptrend forming (discussed in more detail in our Chart of the Week below). The inflation side of the mandate can still rear its ugly head. Per the Fed’s own measures, financial conditions are at their loosest since 2022. Those loose financial condition, which do support economic development and therefore the labor market, also promote inflation. While one cut may not present too much of an impact on either side of their mandate, the expectations for many cuts to come certainly does, hence the importance of Powell’s words.

Equity markets remain confident that navigating the waters described above should be relatively smooth sailing. Looking at the technical picture, we’ve cracked all-time highs on the S&P 500 yet again and and the uptrend still looks well supported. Tech has reasserted its leadership, but market breadth is healthy. September’s reputation as a tough month has not held this year, with investors shaking off seasonal headwinds.

Newton Model Insights:

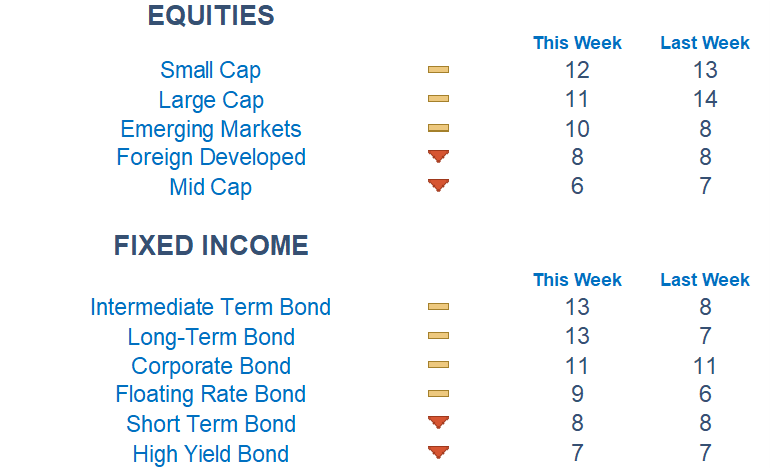

Our Newton Model readings show domestic equities maintaining leadership, though softening slightly in recent weeks. Emerging markets are gathering momentum. Communications and technology, the most exposed to large-cap growth, remain at the top of the pack, while cyclicals like consumer discretionary and energy have weakened. The move lower in rates has also supported intermediate and long-term bonds.

Economic Releases This Week

Monday: None

Tuesday: US Retail Sales, Home Builder Confidence Index

Wednesday: FOMC Interest Rate Decision

Thursday: Initial Jobless Claims, Leading Economic Indicators

Friday: None

Stories to Start the Week

Treasury Secretary Scott Bessent and other US representatives are in Madrid talking trade with Chinese officials .

Retail investors are becoming prominent players in IPOs, traditionally reserved for institutional money

Nepal has appointed former Supreme Court Chief Justice Sushila Karki as prime minister after protests led by Gen Z ousted the country’s last leader

The best American vintage stores aren’t located in the US, instead Tokyo’s thrift scene takes that title

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.