MARKET COMMENTARY

In case you haven’t been paying attention, there’s a lot happening across markets and this week’s developments will touch on nearly every major variable of import to investors. Let’s run through the highlights. The U.S. government continues its second-longest shutdown in history. The White House has renewed optimism that a trade deal with China is once again gaining traction. The Federal Reserve will announce its interest rate decision following last Friday’s optimistic CPI report. Five members of the Magnificent Seven are set to release third-quarter results. And to top it off, we’ll get a fresh PCE inflation report to confirm, or challenge, last week’s data. Meanwhile, the S&P 500 sits at a fresh all-time high.

Of all the fun stuff listed above, earnings reports from five of the largest and most influential firms in the AI revolution may be the most impactful. Apple, Microsoft, Alphabet, Meta, and Amazon now make up roughly a quarter of the S&P 500. How these companies are investing to build AI infrastructure, and how that spending translates into earnings, will have a direct effect on market pricing. So far, earnings season has outperformed historical standards as both the share of companies beating expectations and the size of those beats are above their averages. Tech results in particular have been strong, setting an encouraging tone heading into the week.

In price action, a familiar pattern has reemerged as technology stocks are once again carrying the broader market higher. Breadth, or how well the rest of the market is participating, has improved modestly but is still lukewarm. Monday reinforced this recent theme as high-beta names ripped higher. After a few weeks of hesitation, optimism appears to be returning to the market’s AI flyers.

Newton Model Insights:

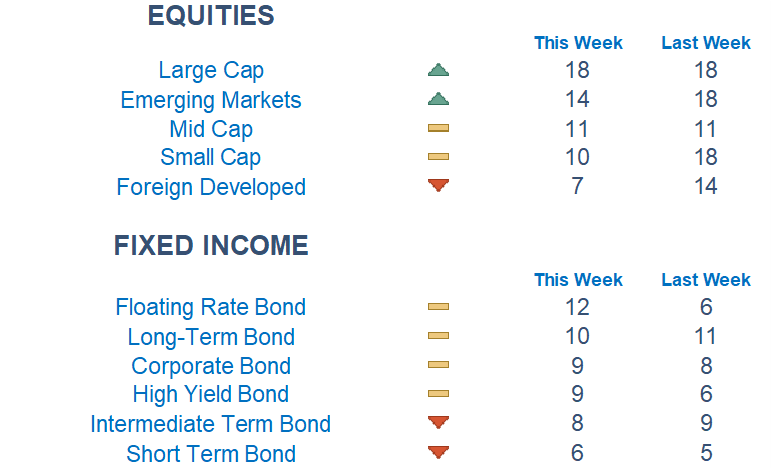

Our Newton model highlights several notable shifts this week. As expected given tech’s leadership, Large Cap stocks continue to stand tall. International equities, strong performers for much of the year, are softening up. Defensive sectors such as Consumer Staples and Utilities are struggling to gain traction, while cyclical areas like Consumer Discretionary and Industrials continue to power ahead.

Economic Releases This Week

Monday: None

Tuesday: Consumer Confidence

Wednesday: FOMC Interest Rate Decision

Thursday: Initial Jobless Claims*, GDP*

Friday: PCE Index*, Chicago Business Barometer

*Subject to delay given US government shutdown

Stories to Start the Week

Argentine President Javier Milei’s La Libertad Avanza party won 41% of the votes with 90% of ballots counted, handily outperforming market predictions

Target is eliminating 1,800 corporate positions. It’s the retail chain’s first major layoff announcement in a decade

Social Security recipients will get a 2.8% cost-of-living adjustment next year, which amounts to an average increase of ~$56 per month for retirees

Two men are in custody following last Sunday’s heist of crown jewels from the Louvre museum

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.