MARKET COMMENTARY

The holiday season is upon us as we enter a shortened, Thanksgiving week. As you and your families pause to gather round and give thanks, this market’s bout of volatility may not grant us a turkey fueled siesta. These three and a half sessions follow a whipsaw of a week which saw intraday gains were wiped-out by even larger losses, despite positive earnings from Nvidia and Walmart. Risk assets are yearning for some support from this pull back and Monday’s session provided a little hope to that end. However, we need to march through a few data points before we get to the big meal.

Before entering the busiest shopping season of the year, we receive intel into how consumers have been spending and where prices have been trending. Retail sales data for September will be released on Tuesday and is expected to increase by 0.4%, following a very strong summer. The same month’s Producer Price Index will also be released, one of the last important data points the Fed will have to make its final decision of the year. The chances of a rate cut have been fluctuating, but last week’s swing in equities helped bring those odds up to the mid 60’s.

Despite the positive performance today, the technical picture has deteriorated swiftly. Price action has hit the year’s big winners the hardest as most stocks with AI in their elevator pitch experience drawdowns. Fear has elevated, new highs have fallen as new lows have picked up, volatility is on the rise and the number of equities in positive stages has tightened. Not everything has been slammed, though. Rotations into underappreciated sectors like healthcare and utilities has provided some assistance. Despite the current sentiment on news channels stoking panic, long term trends for now remain intact and provide some support from a meaningful dive.

Newton Model Insights:

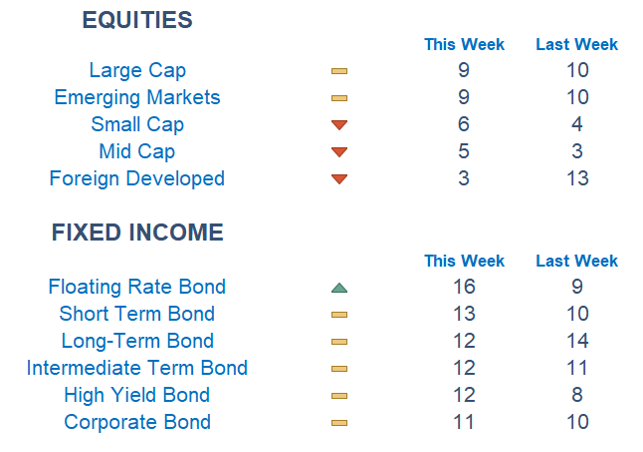

Our Newton model reflects a less attractive view overall this week with few areas of strength. Most categories lie on the lower end of the Newton spectrum while Healthcare and Energy remain resilient, but both worse off than they were last week. Foreign Developed markets experienced a significant decline, along with both Small and Large Value. Large Growth takes the top spot again after last weeks switch to value. Bond market sectors deliver consistent, above average readings.

Economic Releases This Week

Monday: None

Tuesday: Retail Sales (September), PPI (September)

Wednesday: Initial Jobless Claims, Durable Goods Orders (September), Consumer Confidence

Thursday: Happy Thanksgiving!

Friday: Markets close early at 1pm

Stories to Start the Week

Eli Lily becomes first health-care company to hit $1 trillion in market cap, joining the exclusive club dominated by tech firms

Amazon said it will invest as much as $50 billion on AI infrastructure to support U.S. government agencies

Top U.S. and Ukrainian officials said Sunday they’d made progress toward ending the Russia-Ukraine war

OpenAI Launches Baffling ‘Group Chats,’ So You and Your Friends Can Hang Out with ChatGPT

McLaren faced rare double disqualification this weekend, tightening the gap between drivers as we get closer to the championship

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.