MARKET COMMENTARY

Last week witnessed a real turn of events as the S&P 500 recorded its largest drop since Liberation day. The government shutdown may finally have an end in sight with the Senate passing the first stage of a temporary solution Sunday night, now awaiting final approval from the Senate and the House. This would mean after 41 days of shutdown we would finally begin receiving government released data and get a better reading on the economy. If passed, investors and the Fed alike will have valuable information for approaching the rest of the year.

Normally, this is where we would discuss the importance of the CPI report scheduled for Thursday and what the market’s expectations for the data are. Instead, we continue to find ourselves in a data desert looking to third party sources for any indication of how the economy is functioning. From the data we do have, things seem to be holding up okay. The job market, while not thriving, doesn’t appear to be falling off a cliff and dialogue from corporate earnings paints a relatively stable picture. For now, most are in a holding pattern until we get progress on the shutdown itself.

Now, what exactly is the deal that the Senate CAN agree on to end this? Leading up to the shutdown and since, the Affordable Care Act has been the main topic of negotiation with a split vote between continued tax credits and it’s end. Although the issue hasn’t been resolved, enough senators decided that the harmful consequences of the shutdown can’t continue. The decision would push off the ACA decision to December and extend current government funding levels until January, when a final total 2026 spending deal can be reached. Fortunately for government workers, any layoffs during this time will be reversed and missed salaries will be paid in full. Also included are bipartisan budget process provisions designed to prevent a shutdown of this nature from happening again. Many are still not happy, with a divided 60-40 vote in the Senate and continued uncertainty for healthcare policy, but hopefully this means everyone will make their flight home for Thanksgiving!

Newton Model Insights:

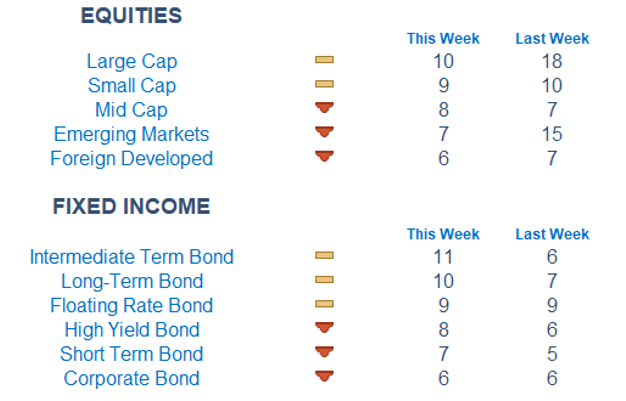

Our Newton model reflected major shifts this week, with majority moving to the downside. Large Cap stocks remain dominate, but took a big hit along with emerging markets. Fixed Income is looking modestly better, but still very average. Healthcare and Utilities are the most promising sectors at the moment per our model, while our prominent leaders in Tech and Large Growth took a dive. Even so, Growth stills overpowers Value in all market segments.

Economic Releases This Week

Monday: None

Tuesday: NFIB Optimism Index

Wednesday: None

Thursday: IInitial Jobless Claims*, Consumer Price Index*

Friday: Retail Sales*, Producer Price Index*

*Subject to delay given US government shutdown

Stories to Start the Week

Pfizer wins bidding war against Novo Nordisk, acquiring obesity drug start up Metsera in $10 billion deal

Cryptocurrency case over $25 million left jurors in tears and ends in mistrial

Senate returned to Capitol Hill Sunday and began early stages of a new deal that could end the government shutdown, at least temporarily

Alleged pitch rigging scheme charging two Cleveland Guardians pitchers

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.