MARKET COMMENTARY

The unpredictability of the stock market was reflected this November as we saw sharp sell-offs contributing to the biggest peak-to-trough fall for the S&P 500 since April, followed by the strongest 4-day advance since May. While shopping this year is expected to remain high, consumers are more budget conscious acting intentionally to find deals to make their dollar go further. Likewise, while spending will increase year over year, a dollar today isn’t going as far as it did last year.

As we head into our final month of the year, the backlog of data continues to roll in with the much awaited PCE report for September released this Friday. While it won’t be up to date, PCE is the Fed’s preferred inflation gauge making it an important metric for them to consider before next weeks FOMC meeting. In the past few weeks, we’ve witnessed the chances of one last rate cut for 2025 be hotly debated with odds swinging from as low as 22%, back up to the current prediction of 87%. Inflation has steadily remained at 3%, 1% above the 2% target, and a low hire, low fire environment has created a difficult job market to enter or move in. As we know the already tough job of balancing the Fed’s dual mandate has been made harder with the lack of economic data from the government shutdown, which has contributed to the changing sentiment on whether we’ll see a rate cut this month.

After a rough last week in terms of price movement, metrics are looking more optimistic. One factor showing positive change is summation, an indicator of long-term market breadth, which has been negative since September until now. A major concern in this market has been heavy concentration leading to a weak breadth. This shift could mean a larger portion of the market is participating in the gains, which is supported by more companies reaching new highs than new lows. Volatility is finally declining after hitting 26.42 in November. The stock market historically behaves stronger in December, so hopefully we experience less negative volatility and can hold onto the gains as 2025 comes to an end.

Newton Model Insights:

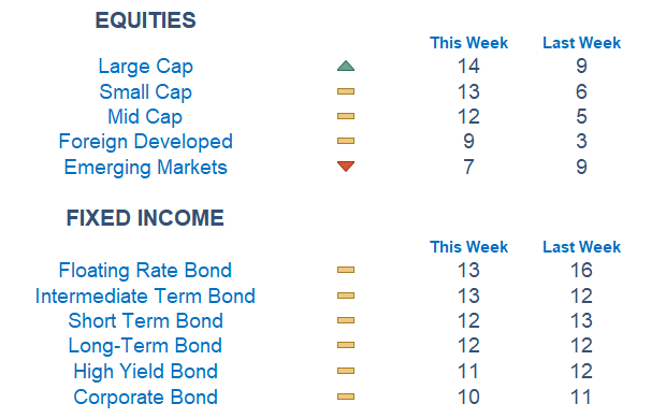

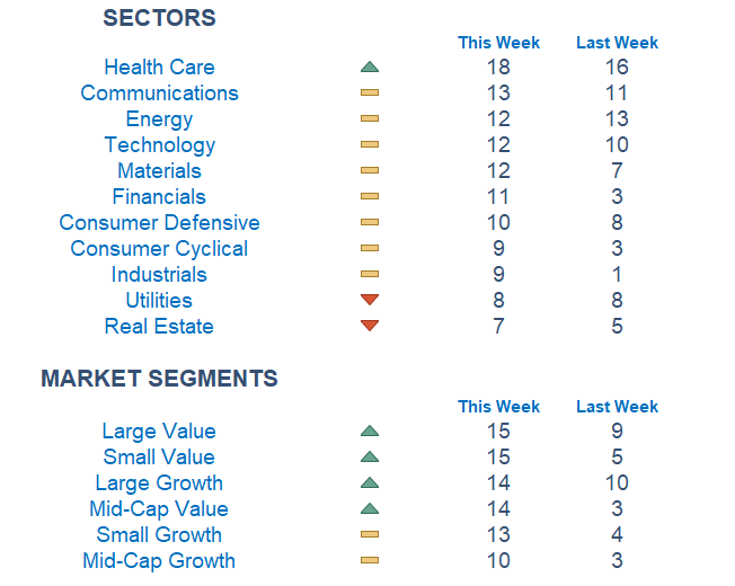

Our Newton model is showing a more positive outlook this week. Equities improved across Capitalizations and Foreign Developed. Fixed Income remains steady and consistent, while Equity markets struggle with volatility. Healthcare continues to be the most attractive sector with Communications and Energy remaining not far behind. In terms of segments, Value and Growth have fluctuated back and forth depending on the week. As of now, most assets have gained traction since last week with Large Value and Small Value the strongest.

Economic Releases This Week

Monday: S&P Manufacturing PMI, ISM Manufacturing

Tuesday: None

Wednesday: S&P Services PMI, ISM Services

Thursday: Initial Jobless Claims

Friday: PCE Index (September), Consumer Confidence

Stories to Start the Week

Trumps says he has picked new Fed Chair to succeed Jerome Powell

Ukraine peace talks continue with U.S. Special Envoy Steve Witkoff heading to Russa to discuss U.S.-backed 19-point peace plan with Putin

The poverty line according to Michael Green should really be $140,000

New Black Friday records and AI is helping shoppers find the best deals

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.