MARKET COMMENTARY

Markets opened the week on a positive note, rebounding from Friday’s sharp losses as investor sentiment improved. Optimism was driven by growing expectations for a Federal Reserve rate cut in September, with odds rising significantly following weaker-than-expected July jobs data. Major tech stocks led the premarket rally, helping lift broader equity sentiment. Despite a cautious note late last week, Monday’s strength suggested that markets may be attempting to regain footing amid increasing hopes of monetary easing.

The July nonfarm payrolls report significantly underwhelmed, with only 73,000 jobs added compared to forecasts of over 100,000. Compounding concern were major downward revisions to May and June positions, totaling more than 250,000 jobs, and a rise in the unemployment rate to 4.2%. These data points suggest a notable cooling in labor market momentum, shifting expectations for Fed policy. In a controversial move, President Trump fired the head of the Bureau of Labor Statistics, citing doubts about the data’s accuracy. Additionally, Federal Reserve Governor Adriana Kugler announced her early resignation, giving the administration another opportunity to influence the central bank’s leadership.

Trade policy and earnings developments remain in focus as well, though the week is light on scheduled economic releases. Many companies are adjusting to newly imposed tariffs through supply chain changes or passing costs to consumers, but growing uncertainty around future trade dynamics is clouding outlooks. Amazon disappointed the market with a softer profit forecast, and breadth in the S&P 500 has narrowed, w key signs that risk appetite may be waning. All eyes now turn to ongoing U.S.–China trade talks in Sweden, the potential Trump–Xi meeting, and how companies navigate profit pressures as data flow remains thin.

Newton Model Insights:

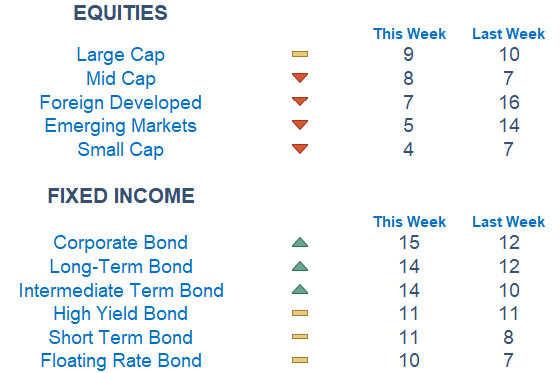

According to our Newton Model, equities have weakened across the board, with US Large Cap remaining at the top though deteriorating week over week. Within sectors, utilities, energy, and industrial remain at the top, while cyclicals, healthcare and financials are the laggards. Growth is still outperforming value, though momentum is starting to fade. Within fixed income, corporate and long term bonds have moved to the top of the leaderboard with yields falling substantially last week as investors flock to risk off assets, as expectations for a fed rate cut are seemingly high for September.

Economic Releases This Week

Monday: Factory Orders

Tuesday: U.S. Trade Deficit, S&P Final U.S. Services PMI, ISM Services

Wednesday: Fed. Gov. Lisa Cook and Boston Fed President Susan Collins on Panel

Thursday: Initial Jobless Claims, U.S. Productivity, U.S. Unit Labor Costs, Wholesale Inventories

Friday: None scheduled

Stories to Start the Week

Elon Musk gets $23.7 billion stock award from Tesla to stay focused

Trump’s warm embrace of India turns cold

Texas democrats leave state to block GOP redistricting, irritating governor

U.S. employment trends weaken, underlining labor market jitters

Mark Zuckerberg just declared war on the iPhone

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.