MARKET COMMENTARY

Markets ended on a higher note last week as Powell left investors increasingly confident on upcoming Fed easing. Outside of the Fed, the big news this week will be Nvidia’s earnings on Wednesday.

In his Jackson Hole speech, the Fed Chair struck a notably different tone, emphasizing that “the balance of risks appears to be shifting,” with particular concern about downside risks in the labor market. He also highlighted that policy is already in restrictive territory and suggested that, given the base case outlook, an adjustment in stance may be warranted. Taken together, this implies Powell no longer views further labor market deterioration as a prerequisite for additional policy easing. Market pricing of a cut next month rose. There are some central bank presidents speaking this week, including Christopher Waller who cast a dissenting vote last meeting.

On the economic data front, inflation will be in focus as we get a read from the Fed’s preferred gauge, PCE. Estimates are calling for a read that shows inflation increased in July. Economists believe the number will come in at 2.9% from June’s 2.8%.

Equity markets opened modestly lower this morning as some of Friday’s enthusiasm around rate cuts faded. The S&P 500 remains close to record highs, while a broader, less tech-concentrated rally has pushed the Dow Jones Industrial Average to fresh all-time highs. Attention now turns to Nvidia, whose outsized weight, nearly 8% of the S&P 500, makes its earnings report a potential catalyst for the next leg higher or lower in markets.

Newton Model Insights:

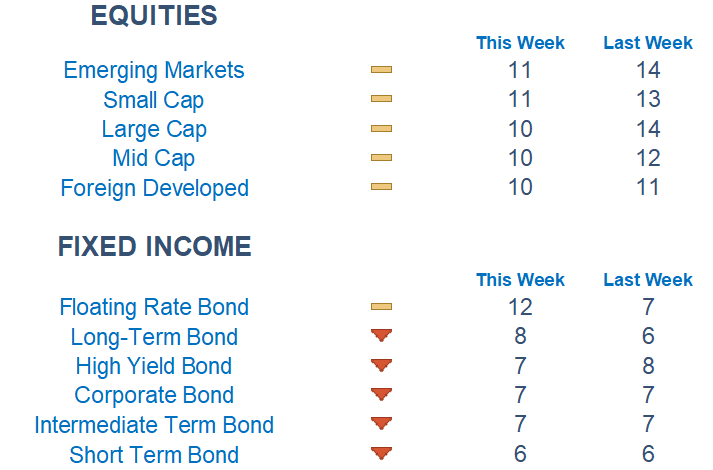

Our Newton Model readings suggest a slight deterioration in most broad areas even with the big push higher on Friday. There was a big rotation out of growth and into value last week which is being reflected by the Newton scores. Additionally, smaller cap names are scoring better than their larger cap counterparts. Within sectors, there were notable gains from those value oriented sectors as Energy, Industrials, and Utilities hold the top spot. Within Fixed income, the story remains the same; as yields remain in a range. Overall, this week’s scores display a cautious tone.

Economic Releases This Week

Monday: New Home Sales, Dallas Fed President Logan Speaks, New York Fed President Williams Speaks

Tuesday: Durable Goods Orders, Consumer Confidence, S&P Case Shiller Home Price Index

Wednesday: None

Thursday: Initial jobless claims, GDP (1st Revision), Pending Home Sales, Fed Gov. Waller Speaks

Friday: Personal Income & Spending, PCE Index, Consumer Sentiment

Stories to Start the Week

Keurig Dr Pepper Strikes $18 Billion Deal for JDE Peet’s

La Tomatina festival begins this week in Spain where participants throw tomatoes at each other.

President Trump on Monday boasted about the government’s new stake in Intel and said he’s determined to do similar deals.

Nvidia will report second-quarter earnings on Wednesday.

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.