S&P 500: 1.27% DOW: 1.07% NASDAQ: 2.21% 10-YR Yield: 4.13%

What Happened?

September is supposed to be turbulent for stocks, but Wall Street is running hot. All the major indices finished the week higher after the Federal Reserve cut rates by a quarter point, its first move lower this year. Jobless claims came in better than expected, falling to 231,000, while consumers proved they’re still ready to swipe, retail sales rose 0.6 percent in August and are up five percent from a year ago. The spending strength suggests the U.S. growth engine isn’t sputtering just yet, giving investors’ confidence that a soft landing is still in the cards.

Not everything was rosy. Housing starts tumbled -8.5% in August, with both new single-family builds and future permits sliding. Mortgage rates have eased into the mid-6 percent range, but affordability and costs are keeping builders and buyers on the sidelines. That weakness highlights the uneven nature of the economy: consumer resilience is propping things up, while housing continues to flash red. Markets are betting the Fed will keep cutting carefully, trying to balance slowing growth without letting inflation reignite.

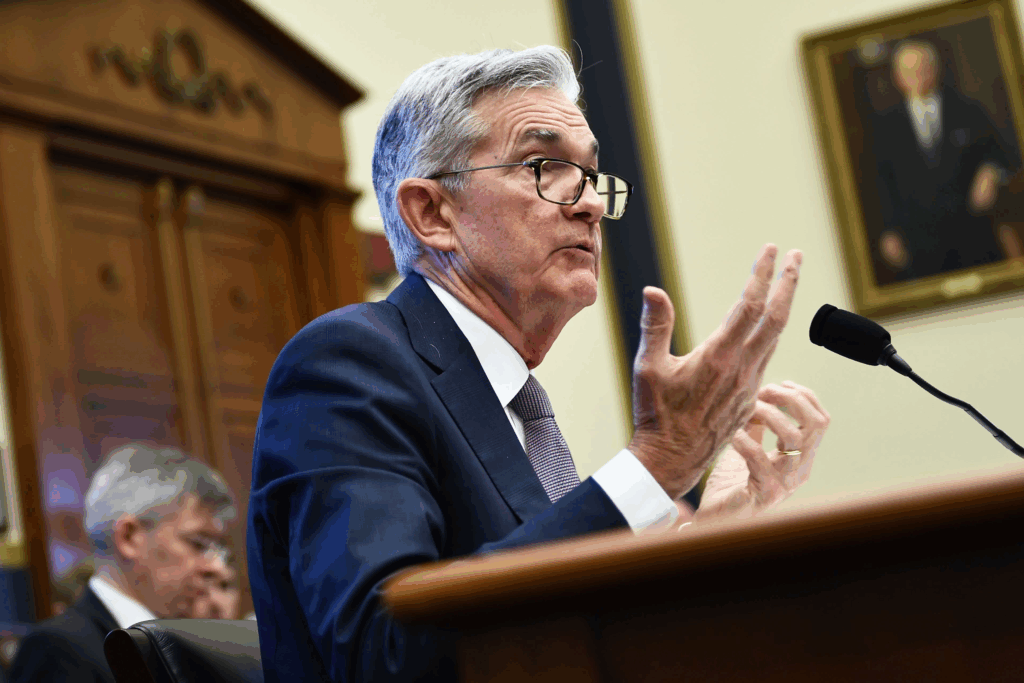

Treasury Yields, Dollar Rise Following Fed Cut

- The Fed cut 25 bps to a 4.00%–4.25% target range.

- A visible minority argued for 50 bps, including new Governor Stephen Miran’s dissent, and some banks such as Standard Chartered after weak August jobs data.

- Powell called the move “risk management,” kept guidance data-dependent, and avoided pre-committing to a cut path.

The key takeaway – September’s Fed meeting delivered the smaller, 25 bps cut that most expected, taking the funds rate to 4.00%–4.25%. The contrast, and the story, came from those pushing for 50 bps who argued the unemployment rate has climbed and hiring has cooled, so waiting risks a harder landing later. Stephen Miran formally dissented for a half-point, and Standard Chartered publicly flipped to a 50 bps call after the weak August jobs report, underscoring that the “go big” view was really about cushioning a slowing labor market rather than celebrating strong growth or tame inflation. Inflation is still above target, which is exactly why the majority stayed cautious with 25.

What moved markets most was the press conference. Powell framed the cut as risk management, said decisions will be made meeting by meeting, and stressed that future moves depend on how jobs and inflation evolve. That tone pulled expectations toward additional quarter-point steps rather than a quick dash, while officials like Neel Kashkari floated the possibility of two more cuts if labor data keeps softening. In short, the Fed opened the easing door, but Powell made clear he is not sprinting through it.

China’s economic slowdown deepens in August with retail sales missing expectations

- Unemployment edged higher at 5.3% from 5.2%.

- Retail sales rose 3.4% YoY from last month’s 3.7% figure.

- Fixed asset investment grew only 0.5%, a sharp slowdown from previous.

- China’s consumer price index fell more than expected dipping 0.4% from a year ago.

The key takeaway – China’s economy is losing momentum, with slowing growth in consumption, industrial activity, and investment. The weakness is concentrated in real estate and the private sector, while state-led projects and targeted policy support are doing the heavy lifting. At the same time, deflation risks are lingering.

Still, there are areas of resilience as spending is shifting toward services and lifestyle-related goods, rural demand is holding up better than urban, and policy support continues to trickle in. Economists expect more targeted easing rather than sweeping stimulus, as Beijing works to balance stability with its growth target. Markets, already anticipating a softer third quarter, reacted calmly to the data.

From Around the Watercooler

Trump Says U.S. and China Approve TikTok Deal After Call With Xi

Inside Disney’s Abrupt Decision to Suspend Jimmy Kimmel’s Show

All the Reasons Trump Would Be Wrong to Ditch Quarterly Earnings

Wall Street bets on chip boom are getting more concentrated