S&P 500: -1.90% DOW: -1.86% NASDAQ: -2.73% 10-YR Yield: 4.06%

What Happened?

Gobble or wobble? Markets didn’t care that Thanksgiving was near, they leapt and lurched all week, leaving indexes wobbling on uncertain footing. Relentless headline swings pushed prices up and down with rare single-day selloffs, fueled by strong earnings reports, spiking AI valuation fears, profit taking, hotter-than-expected jobs data, fading odds of a December Fed cut, and then new hints of support for future easing from Fed chairs. Investor mood was anything but calm, as Wall Street digested how to feel about Q3 report cards and unprecedented capital expenditures from tech giants. While these firms delivered strong revenue growth, investors grew wary of how much future risk is being baked into today’s elevated valuations, questioning whether relentless investment in AI and infrastructure is sustainable with clouds gathering in the macro-outlook.

Against that backdrop, three swing factors stole the show: the long-delayed September jobs report from the Bureau of Labor Statistics showed hiring strength but more unemployment; Nvidia delivered blockbuster Q3 earnings underscoring the staying power of the AI boom; and John Williams’ latest Fed commentary revived hopes for a rate cut soon. Each headline carried an asterisk, as markets already feel priced for perfection – making every rally a tightrope act and every dip another reminder that the crowd’s confidence is balanced on a knife’s edge.

Hiring Defied Expectations in September, With 119,000 New Jobs

- Nonfarm payrolls: +119k vs. +50k consensus.

- Unemployment rate: ticked higher despite stronger‑than‑expected hiring.

- Market pricing for a December Fed cut: implied probability down from ~90% to ~25%.

The key takeaway – Now that the government has officially reopened, the September jobs report finally hit the tape—and it came in hot, with payrolls surging by 119,000 versus expectations for just 50,000. At the same time, the report showed that unemployment inched higher, underscoring some emerging slack beneath the surface of an otherwise resilient labor market. With the shutdown having disrupted data collection, officials also confirmed there will be no October report, leaving policymakers and investors flying partially blind heading into year‑end.

On balance, the data paint a mixed picture for markets. A still‑firm labor market, paired with the lack of fresh October data, has sharply reduced the odds of a December rate cut from the Federal Reserve—from around 90% to roughly 25%—as there is little urgency for stimulus with hiring this strong. With fewer data points to challenge that narrative, traders have grown uneasy, and equities have sold off into the end of the week as investors reassess the path of policy and growth.

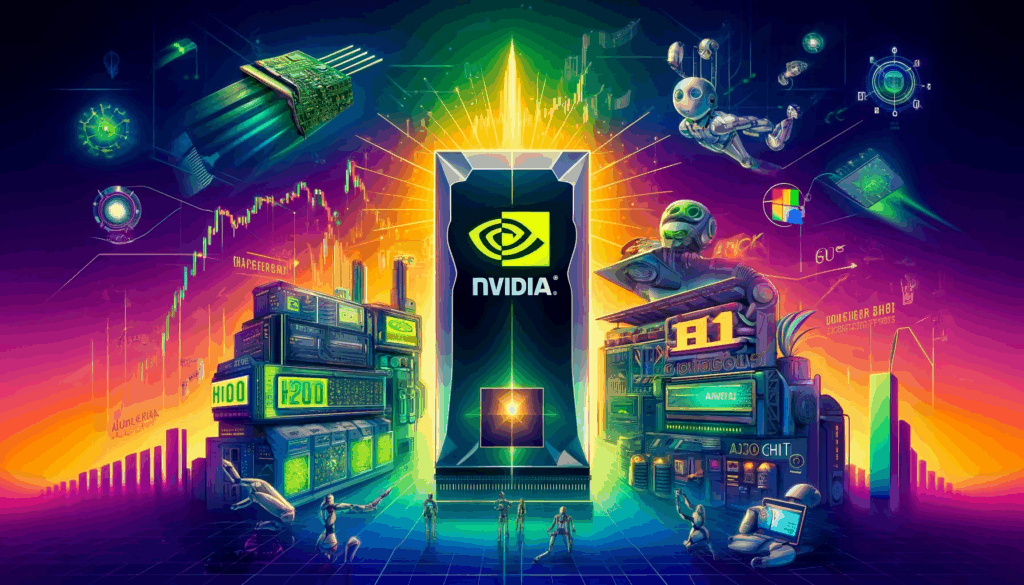

Nvidia(NVDA) earnings report Q3 2026

- CEO Jensen Huang said sales for Nvidia’s current-generation GPU, called Blackwell, are “off the charts.”

- Nvidia said it expects about $65 billion in sales in the current quarter, versus $1.43 in earnings per share on $61.66 billion of revenue expected by analysts.

The key takeaway – Yet again, the tech giant Nvidia proved why it is the world’s first $5 trillion dollar company, blasting through earnings expectations and reinforcing its leadership at the core of the AI revolution. Despite a recent dip in the fear vs. greed index and skepticism about the sustainability of AI-driven growth, CEO Jensen Huang assured investors that demand for Nvidia’s Blackwell GPUs remains “off the charts, with cloud GPU inventories sold out, even without sales to China due to ongoing U.S. export restrictions. Wall Street’s doubts over whether the torrid pace of AI infrastructure buildout could continue were dismissed by a $57 billion revenue quarter, up 62% year-over-year, almost entirely fueled by data center demand from U.S. and global cloud hyperscalers.

With the weight of the stock market resting on its shoulders, Nvidia’s blockbuster earnings initially ignited a broad rally, sending the Nasdaq and S&P 500 surging at the open. But enthusiasm quickly faded, as investors rotated out of AI winners and took profits after the largest single-day intraday reversal since April. The Nasdaq ultimately closed down 2.2%, and the S&P 500 suffered its most significant drop from an intraday high to negative territory since the spring tariff-driven “Liberation Day” sell-off. While Nvidia’s results reaffirmed the strength of AI demand, the mixed market reaction highlights the growing tension between red-hot fundamentals and investor sentiment anxiety over valuations, cyclical risk, and future guidance

Why John Williams’ remarks matter so much

- New York Fed, stated that there is “room to lower interest rates in the near term,”.

- Williams emphasized the Fed’s dual mandate, saying it is “imperative to restore inflation to our 2% longer-run goal on a sustained basis” without creating undue risks to maximum employment.

The key takeaway – John Williams, President of the New York Fed, injected new volatility into rate cut speculation this week as he broke from the usually cool, coded central banker script and openly discussed the possibility of loosening policy come the next Federal Reserve Board meeting in December. In a sharp departure from the hawkish chorus just weeks ago, Williams signaled that recent economic data, particularly signs of cooling inflation and some softening in the labor market, have “created room for the Fed to consider easing sooner rather than later,” igniting a fresh wave of repricing across bonds, equities, and interest rate futures.

Markets reacted instantly, with traders ramping up bets on a December rate cut even as other Fed officials reinforced that risks remain two-sided, reminding investors that the fight against inflation is not yet won. Williams’ remarks landed just after blockbuster quarterly results from Nvidia

and other tech leaders initially triggered a risk-on rally, only for profit-taking and valuation worries to spark one of the biggest intraday reversals of the year. The combination of renewed Fed dovishness, ongoing economic crosscurrents, and red-hot tech earnings underscores why asset prices remain glued to the macro narrative, each headline tipping the scales between hopes of a policy pivot and the undeniable weight of elevated valuations and cyclical uncertainty.

From Around the Watercooler

Amazon layoffs

The ‘Golden Handcuffs’ Are Off: Private-Equity Employees Leave for Smaller Firms

Google’s Nano Banana Pro model makes AI images sharper, cleaner, and far more real

Verizon Begins Laying Off More Than 13,000 Employees

Health and Science

Eli Lilly hits $1 trillion market value, a first for a health-care company