S&P 500: 0.71% DOW: 0.75% NASDAQ: 2.24% 10-YR Yield: 4.10%

What Happened?

Just as we hope you made it through a haunted Halloween with a few frights but better for it, the equity market also escaped October on an adrenaline-fueled high note. The S&P 500 notched yet another all-time high, shrugging off a week filled with potential headwinds. Investors had plenty to digest including a continuation of the U.S. government shutdown, a Federal Reserve rate decision, and earnings reports from five companies representing roughly 25% of the index within a 24-hour span. Add to that the AI bubble narrative, which has reached supersonic levels in market discourse. Despite all that, we capped off our third straight weekly gain fueled primarily by hopes that AI has the juice to keep this market moving higher.

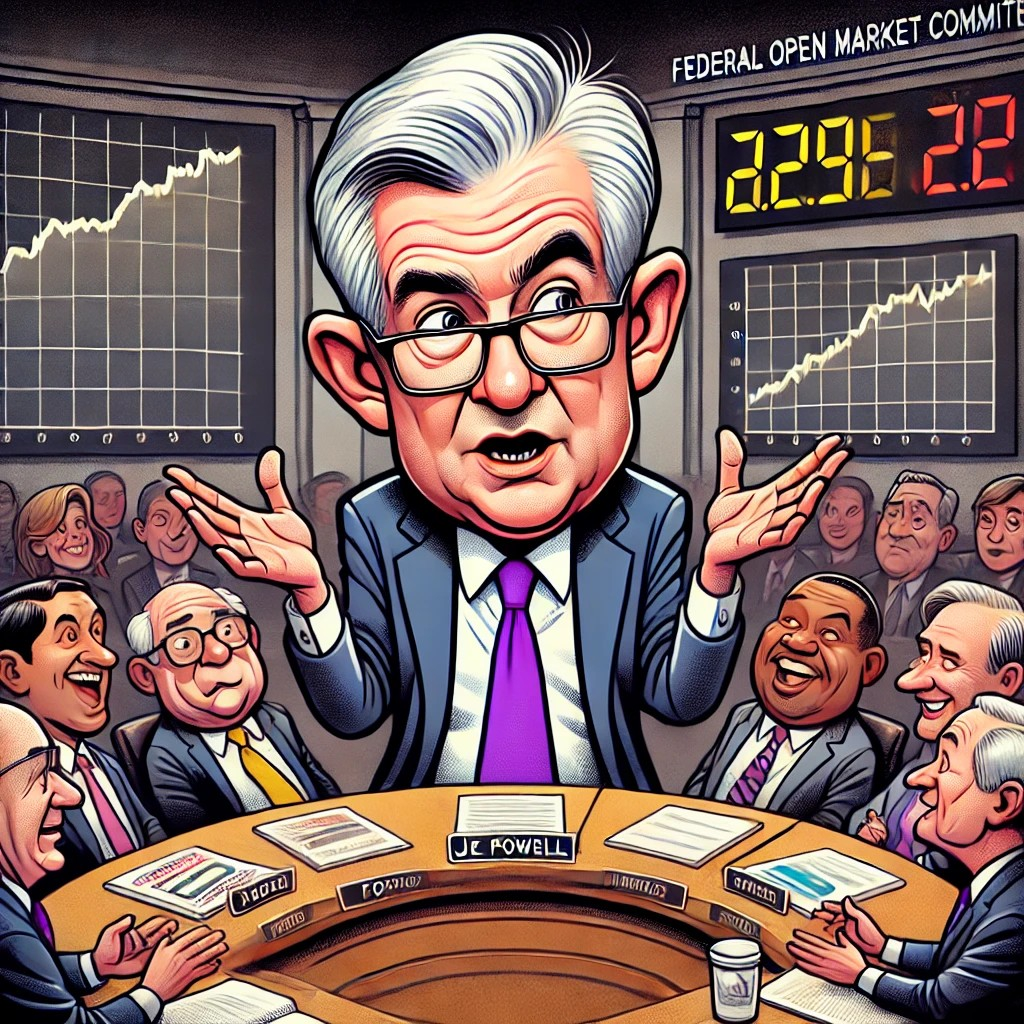

Fed Chair Jerome Powell took his chance to make waves following the FOMC’s decision to cut rates by 25 basis points, a move that was widely anticipated with over 95% odds heading into the meeting. What unsettled markets, however, was his tone regarding the upcoming December meeting. Despite market expectations for another rate cut above 90%, Powell clarified that such an outcome was far from guaranteed. Bond yields quickly jumped, and equities wavered before turning their focus to a pivotal week of AI-heavy earnings.

Those reports were mixed but ultimately helped lift the broader market. Investors were eager to see how major tech firms are translating AI investments into revenue and earnings growth. While most names saw muted reactions, Meta and Alphabet stood out with dramatic swings. Concerns that Mark Zuckerberg’s aggressive AI spending, especially toward general artificial intelligence, was overreaching sent Meta shares down 12% for the week. Meanwhile, Alphabet impressed with strength in Google Cloud and Search growth, beating expectations and sending its stock up 8%.

Fed Cuts Rates — Uncertainty Looms Over What’s Next

- The Federal Reserve cut rates by 25-bps, setting the federal funds rate to a range of 3.75% to 4%.

- The balancing act of persisting inflation above the 2% target and the significant slow down in job growth continues.

- This data dependent Fed was forced to decide without key data with the U.S. government shutdown on day 31, leading to less certainty in policy actions to come.

The key takeaway – The Fed met this Wednesday, where the decision was made cut rates for a second meeting in a row. This was no surprise, as the consensus to see a 25-bps cut lingered above 95% in the week leading up. Before Jerome Powell’s post-decision speech, many were confident in one more rate cut taking place in December. Now, this confidence has dampened as Powell expresses his concerns regarding two committee dissents and the lack of new data due to the U.S. government shutdown.

The decision to cut rates was driven by growing concern for the labor market as companies hold back on hiring and job growth continues to slow. Inflation, however, lingers almost 1% above the target, a major obstacle the committee must consider when cutting rates. Combine that with a lack of key data form the government during the shutdown and the Fed is looking at a complicated policy environment.

Big Tech’s AI Spending Fuels U.S. Economic Expansion

- Current estimates guess that AI-related inputs account for over half of GDP growth, around 1%, for the first 6 months of 2025 and expect this trend to remain.

- Big tech including Meta, Microsoft and Alphabet reported earnings this week touting their major contributions to GDP from AI investments.

- This investment is drastically increasing the need for more infrastructure and power, but long-term uncertainty as to the theme’s full impact remainsht technical signals.

The key takeaway – Despite economic difficulties facing the average person one thing remains consistent, the big tech spending on artificial intelligence. The AI investment boom that started in late 2022 continues to ramp up, with Meta, Microsoft, and Alphabet forecasting increased spending in their latest Q3 earnings announcements. This boost reflects growing demand for data centers, which require specialized software and equipment to power AI. Spending for these companies has already doubled compared to last year, with reported capital spending at $78 billion. As these companies continue to reach new all-time highs in stock price, the debate remains: can this growth can be maintained, or is the economy is experiencing another bubble waiting to burst.

How will this impact the average consumer? More demand for electricity will likely increase electricity bills that are already outpacing inflation and soon capacity. On the other hand, positive job creation is likely as the need for power plants grows. Companies investing in AI means that shareholders are investing and seeing greater gains on their portfolios. More money means more spending from consumers invested in these companies, further stimulating the economy. There is a balancing act here as AI eliminates jobs in certain areas, as reported recently by firms like GM, but provided opportunity for broad economic growth and productivity gains.

Government Shutdown Threatens SNAP Benefits for Millions

- 42 million Americans receive food assistance through the Supplemental Nutrition Assistance Program (SNAP), previously known as food stamps.

- Due to the government shut down, distribution of November SNAP benefits may be delayed putting Americans at risk.

The key takeaway – With Congress unable to come to an agreement on funding federal agencies and programs, Americans continue to face the consequences. For the past month, government employees have missed their paychecks; now, Americans utilizing SNAP risk losing their benefits for November. The impact on low- and no-income households relying on the program may be significant, even with the action being taken to find funding.

Through federal court, the Trump administration is required to use contingency funds to cover a portion of the program, but $4 billion of the $9 billion program will be left up to the states. Many SNAP households rely on the funds to cover over 60% of their grocery bill, so this cutback and delay may be astronomical if not solved in the very near future. Likewise, with less money flowing to consumers to spend at grocery stores, the effects domino, with less money circulating. As the second-longest government shutdown persists, what happens next?

From Around the Watercooler

Hurricane Melissa was the largest hurricane in Jamaica’s history

Grammarly rebrands to “Superhuman” and launches a new AI assistant

2 suspects have acknowledged their involvement in the Louvre Heist. The jewels are still missing.

Palantir sues 2 ex-employees who now work at Percepta over deception and stolen documents