Source: Bloomberg, Waterloo Capital

Noise, noise, noise. Earnings beats and misses, Fed governors being fired, continued geopolitical flare-ups, tariff threats, megacap dominance – the headlines are relentless. But as always, market headlines are not the same as market behavior.

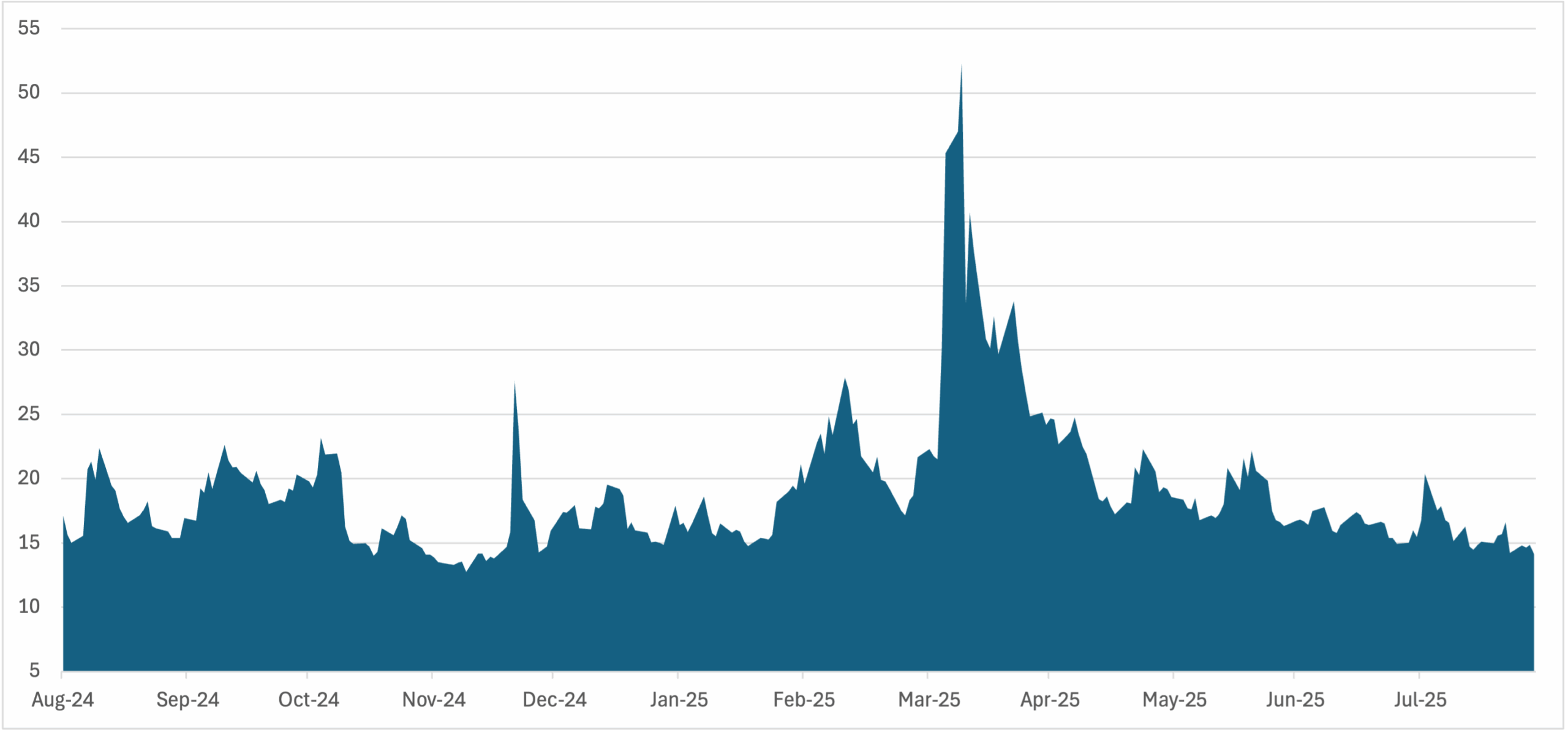

The CBOE Volatility Index (VIX), often called Wall Street’s “fear gauge”, is telling a very different story as it sits at its lowest level since December. This suggests that options traders see little near-term risk of large market swings. In practical terms, a low VIX reflects investor complacency or confidence (depending on your interpretation) that volatility will remain muted.

This calm is being supported by the summer slowdown in trading volumes, a run of stronger economic data and upward revisions, and a Federal Reserve that looks increasingly likely to cut rates in the coming months. The disconnect between noisy headlines and quiet markets is striking, but it shows the resilience investors are leaning on.

Looking ahead, September has historically been the weakest month for equities, with the S&P 500 posting an average decline of 0.7%. It’s a reminder that calm waters can shift quickly. Still, 2025 has been defined by rotations: foreign equities and defensives leading early, megacap tech driving the middle stretch, and more recently, a shift toward areas offering better risk/reward. In this environment, maintaining balance across leadership themes, cyclical opportunities, and quality defensives remains key. Markets may stay calm for now, but history suggests the ability to adapt is what ultimately drives returns.