Since President Trump first uttered the word “tariff,” economists and market participants have been debating their ultimate impact on the U.S. economy, which these policies are promoted to protect. By the time of the Liberation Day announcements, warnings from economists that import levies could undermine economic strength had escalated into outright alarm. Yet, to date, those concerns have not fully materialized in the growth and inflation data.

The chart below hints why. Barclays economists examined how much importers have actually paid at the port amid the most significant tariff increases in nearly a century. Their findings: the effective tariff rate across all U.S. imports stood at 9% in May, well below both current expectations of 12% and the likely ultimate level of around 15%. The shortfall reflects companies shifting purchases from higher-tariff markets, like China, to lower-tariff alternatives. As a result, more than half of imports have avoided duties altogether. This has muted the drag on GDP relative to the scenarios feared in April.

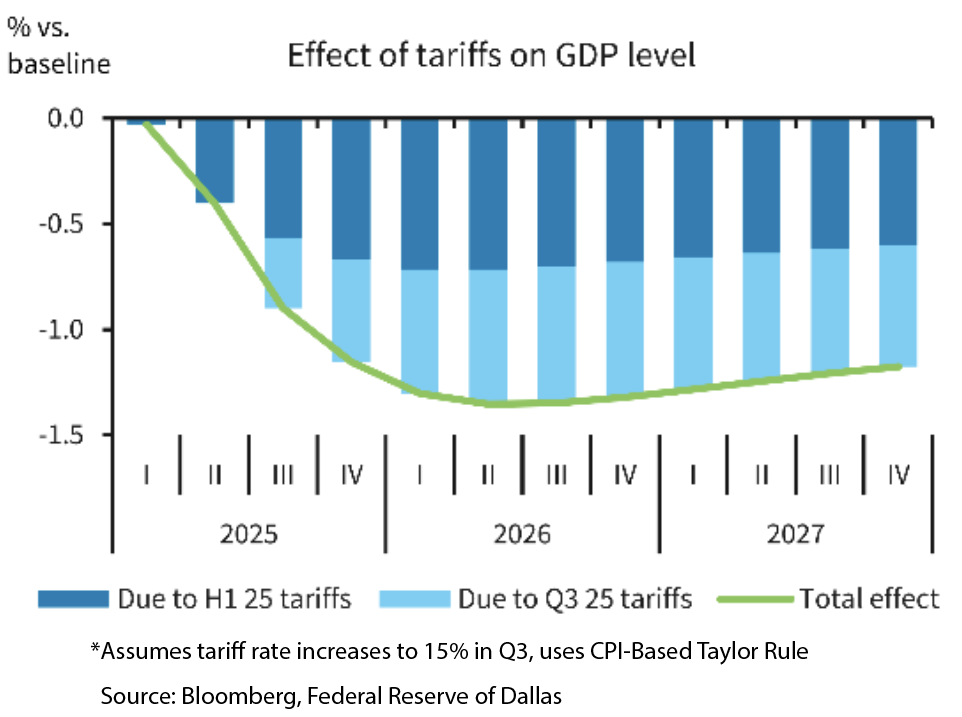

However, that cushion may be temporary. As exemptions expire, additional levies remain under consideration, and pre-tariff inventory build ups run dry, the dampening effect could fade. If the effective rate does rise toward 15%, the impact on growth in the coming quarters could become far more pronounced.

An increase in tariff duties may also spill into inflation. As the policy path has become clearer, companies are better positioned to decide how to manage costs. Should they choose to protect margins, consumers may face higher prices ahead.