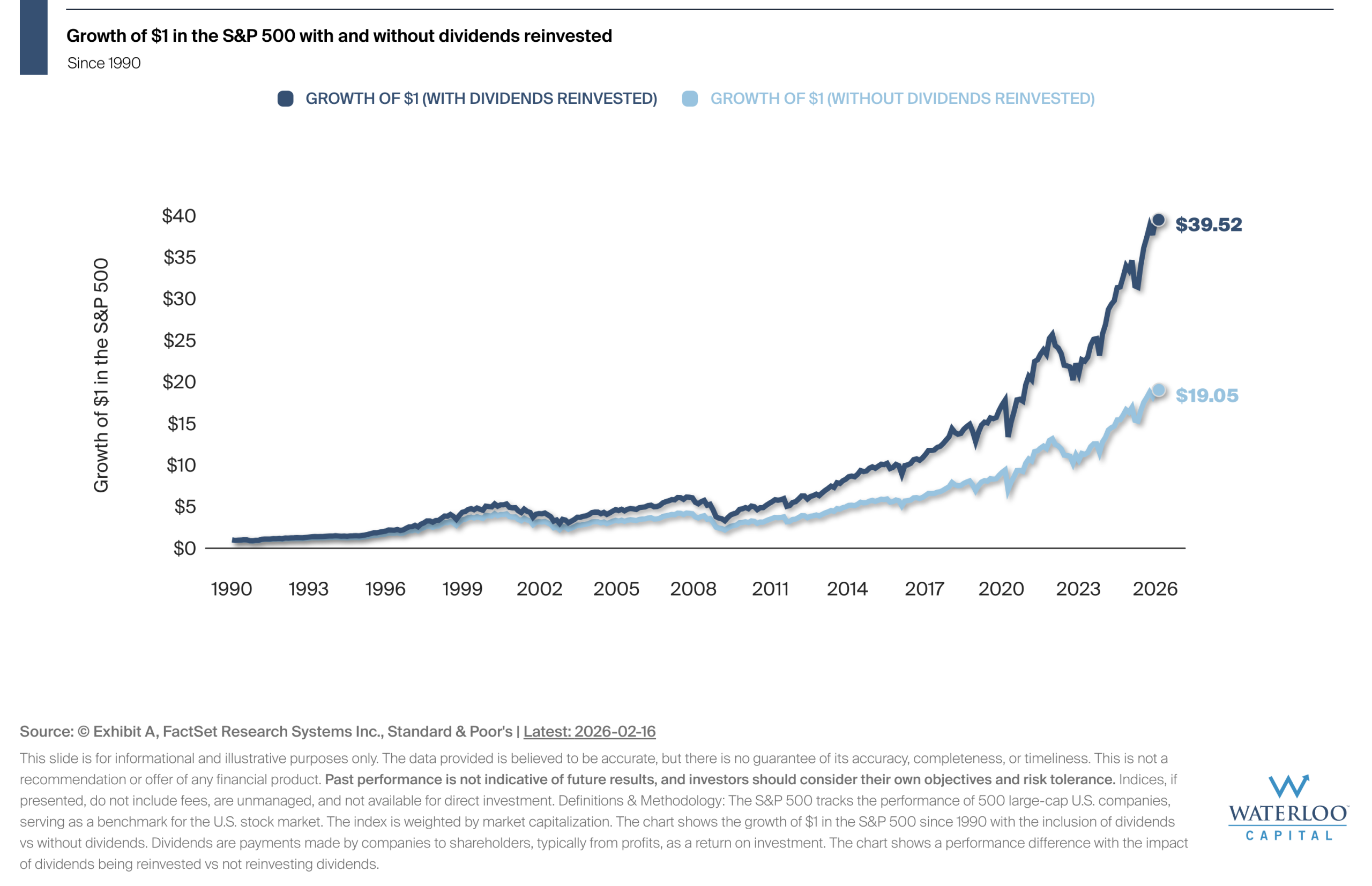

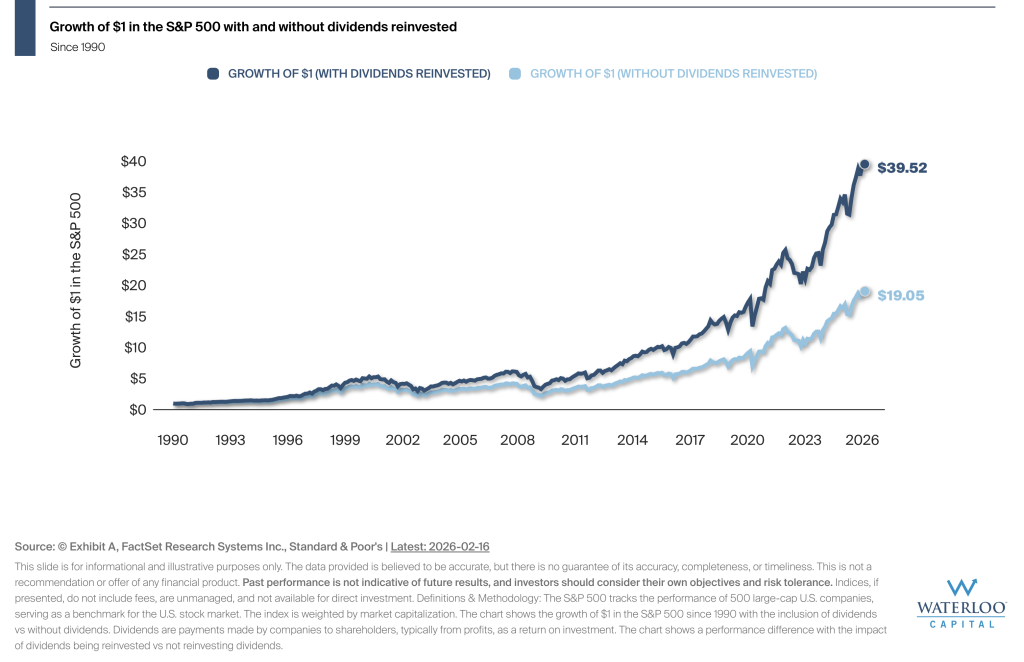

The chart illustrates the power of dividends in driving long-term growth. When dividends were reinvested, the $1 invested in the S&P 500 grew significantly more over time compared to an investment without reinvested dividends.

As of February 13, 2026, a $1 investment in the S&P 500 with dividends reinvested (since 1990) would have grown to $39.52. However, a $1 investment in the S&P 500 without dividends reinvested would have grown to just $19.05 over that same timeframe.

The chart emphasizes the value of a buy-and-hold investment strategy that includes reinvesting dividends. The compounding effect of dividends has dramatically enhanced the growth of an investment in the S&P 500 over time.