As expected, the Fed held rates steady for the fifth straight meeting this week. But beneath the surface, the central bank’s balancing act is becoming increasingly precarious. Despite criticism from President Trump and others within the FOMC, the Fed is navigating a growing divergence between inflation and growth expectations, a trend that puts them in a no-win situation.

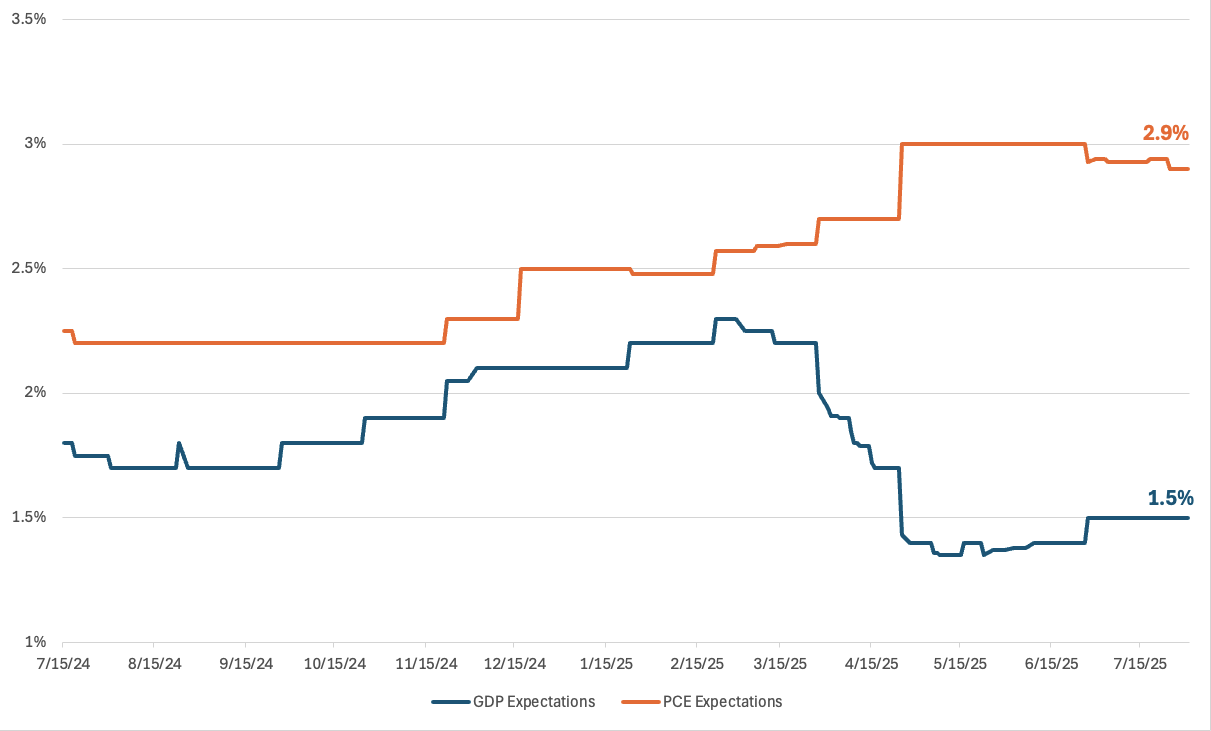

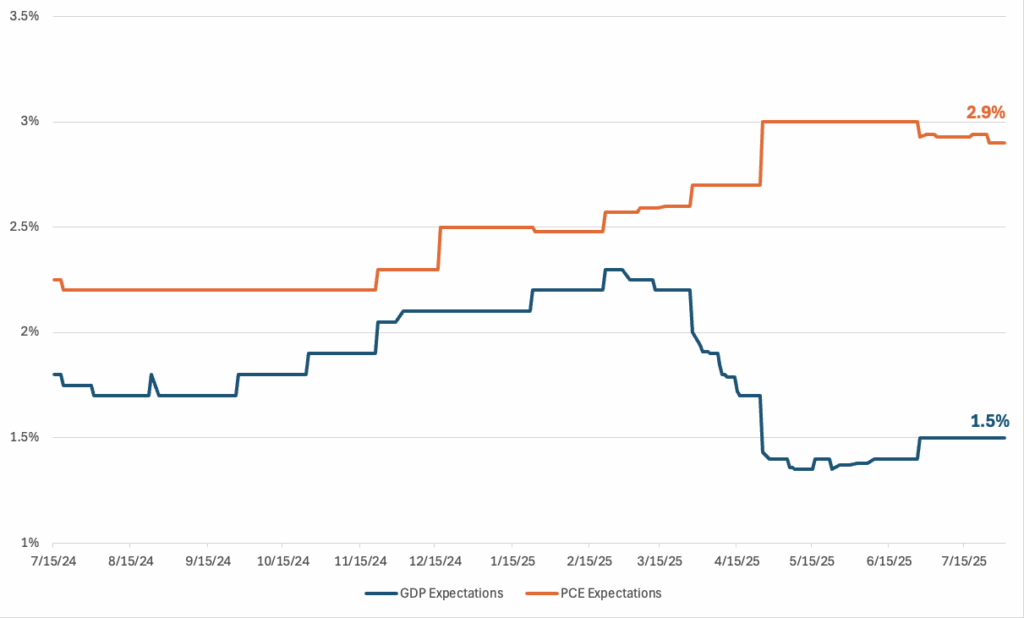

Our chart highlights this disconnect. Towards the right edge, you can see inflation expectations, measured by PCE, remain stubbornly high, hovering near 3%, while GDP growth forecasts continue to fall, recently slipping to around 1.5%. This kind of split is reminiscent of a stagflation-lite scenario: sticky inflation paired with softening economic growth.

For consumers, the impact is already being felt. Elevated inflation, partly driven by tariffs and supply constraints, erodes purchasing power and raises the cost of everyday goods. At the same time, weakening growth often translates into reduced business investment, slower hiring, and less wage momentum.

While Chair Powell continues to cite a strong labor market, headline numbers like the unemployment rate can be misleading. Both labor demand and supply are falling masking the real deterioration happening underneath. Friday’s jobs report was a clear example: hiring hit its weakest pace in years, and past payrolls were revised aggressively lower.

This is what makes the Fed’s job so difficult. We’re likely in an income-driven slowdown, where a strained consumer base is directly curbing business activity. That dynamic then feeds back on itself where businesses cut costs, consumers grow weaker, and so on. In this environment, cutting rates may be necessary – not because inflation is beaten, but because growth is faltering. And that’s a recipe for potential market volatility and persistent economic strain.