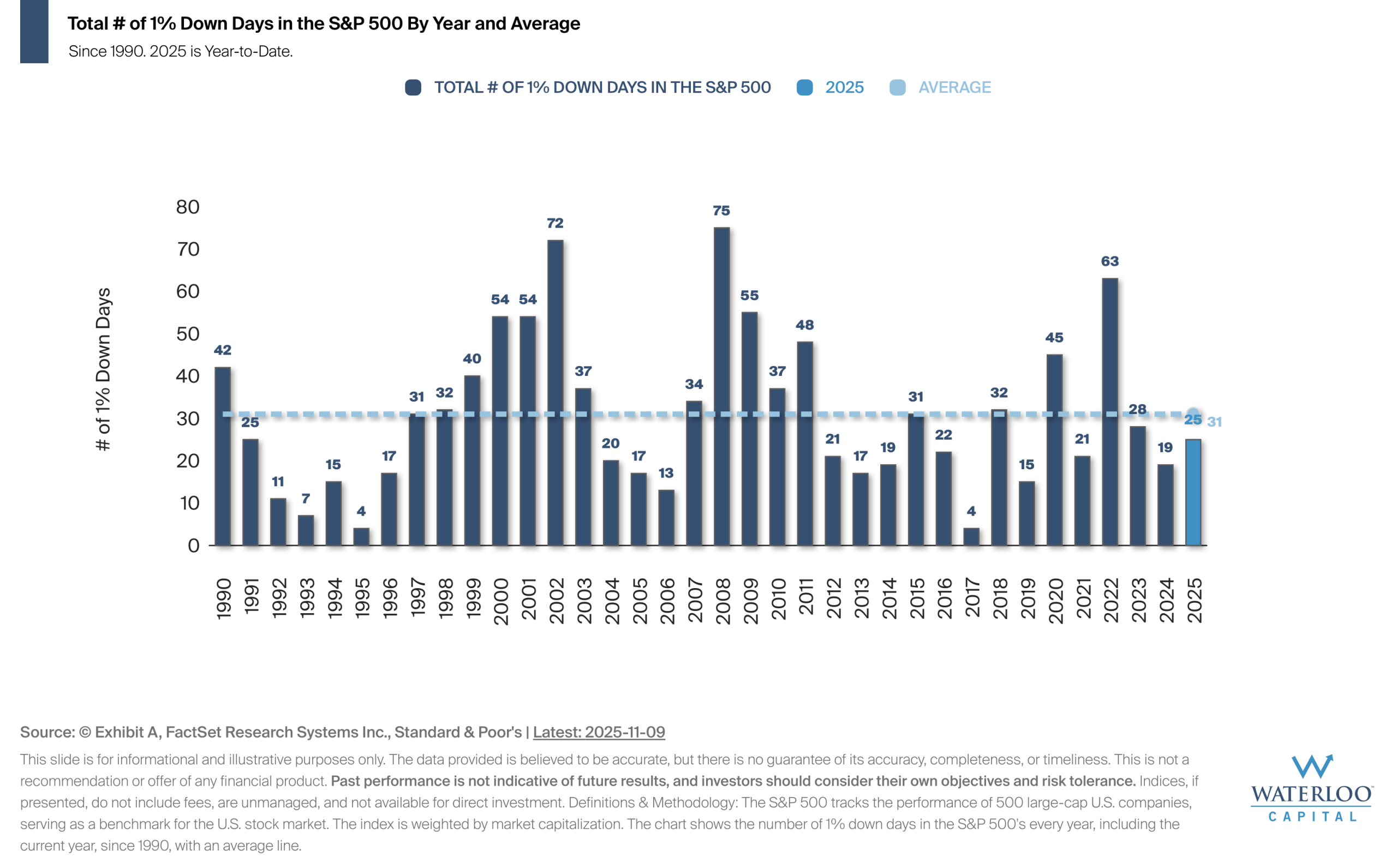

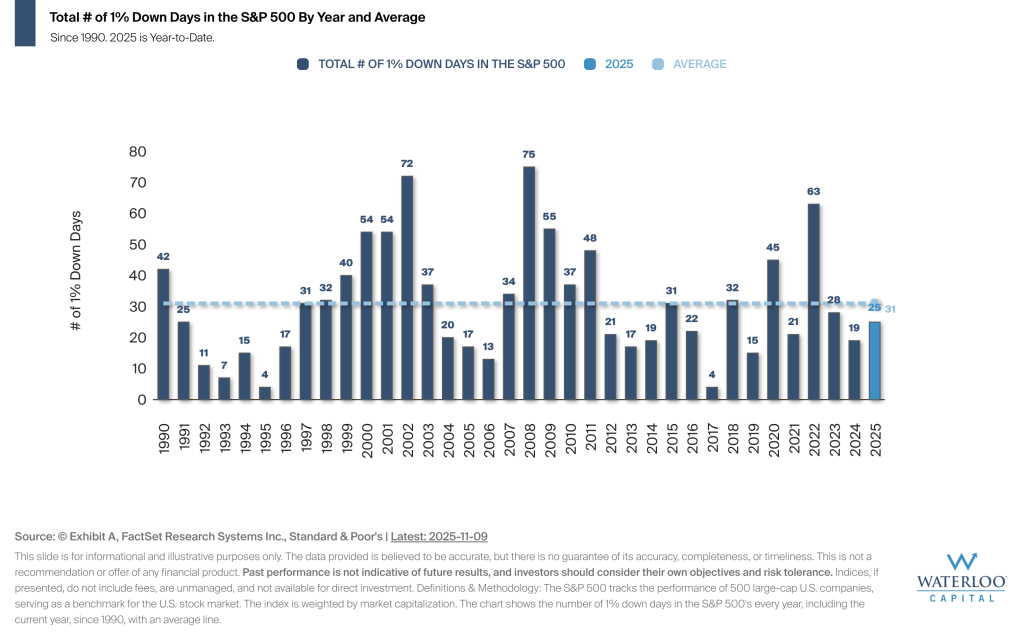

The chart shows that large market declines of 1% or more happen regularly — on average, there have been 31 such days each year since 1990. While these drops can be unsettling, they are a natural part of investing in stocks and should be expected.

In 2025, the S&P 500 has experienced 25 days with declines of 1% or more.

Despite daily fluctuations, the stock market has historically rewarded long-term investors. Staying disciplined through volatility has allowed investors to benefit from the S&P 500’s long-term upward trajectory over time.