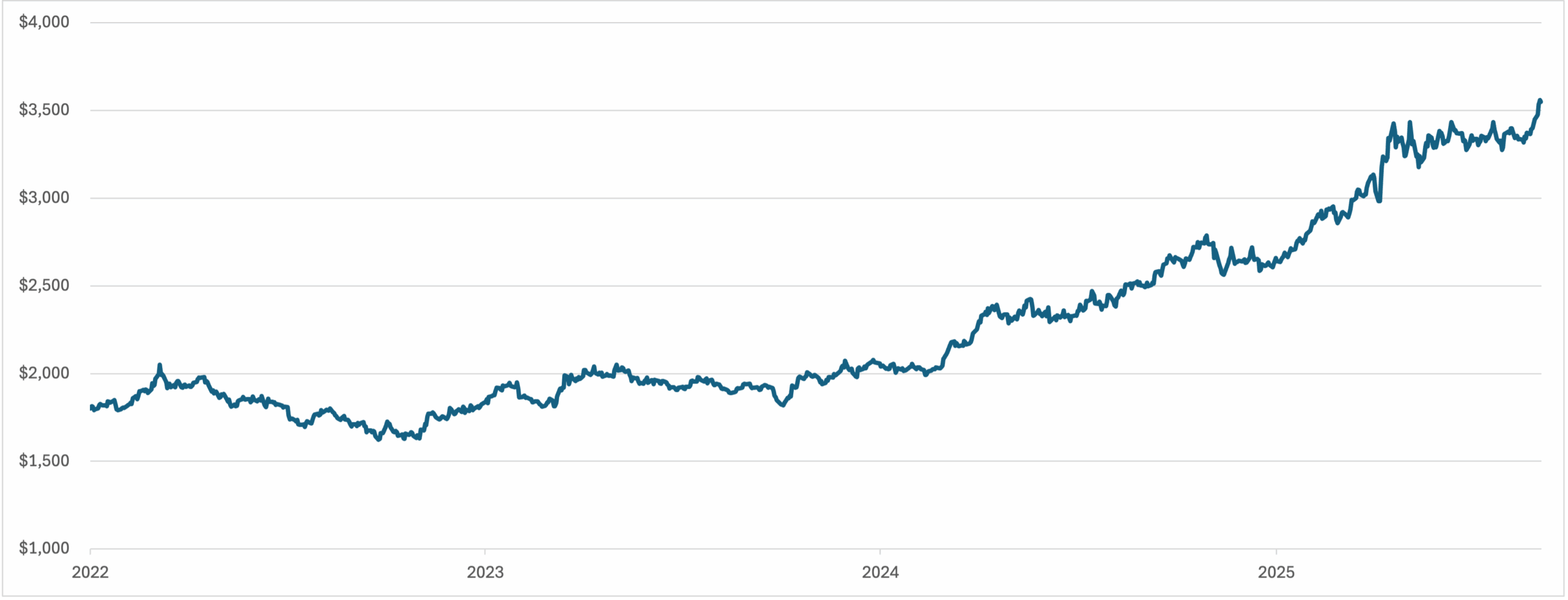

Source: Bloomberg, Waterloo Capital, Data as of Sept 4,2025

Gold has surged more than 30% this year to record highs, fueled by aggressive central bank buying and growing expectations that the Federal Reserve will soon pivot toward rate cuts. Its appeal has been further reinforced by mounting uncertainty around U.S. monetary policy, with investors increasingly turning to the metal as a hedge against both inflation and systemic risks. In the wake of the new record, Goldman Sachs released a note projecting that gold could climb to nearly $5,000 an ounce if just 1% of privately held U.S. Treasuries shifted into the metal, a scenario they warn could materialize if the Fed’s independence is undermined. Analysts led by Samantha Dart cautioned that such a breakdown would likely mean higher inflation, weaker equities and long-dated bonds, and even an erosion of the dollar’s reserve-currency role. In contrast, they highlighted, gold stands out as a store of value that requires no institutional trust. Against this backdrop, bullion has emerged as a focus for investors seeking both diversification and safety in an increasingly uncertain landscape.