Chart Of the Week – Expected Inflation in the U.S.

The breakeven inflation rate represents the market's expectation for average annual inflation over a specific time-period, calculated[…]

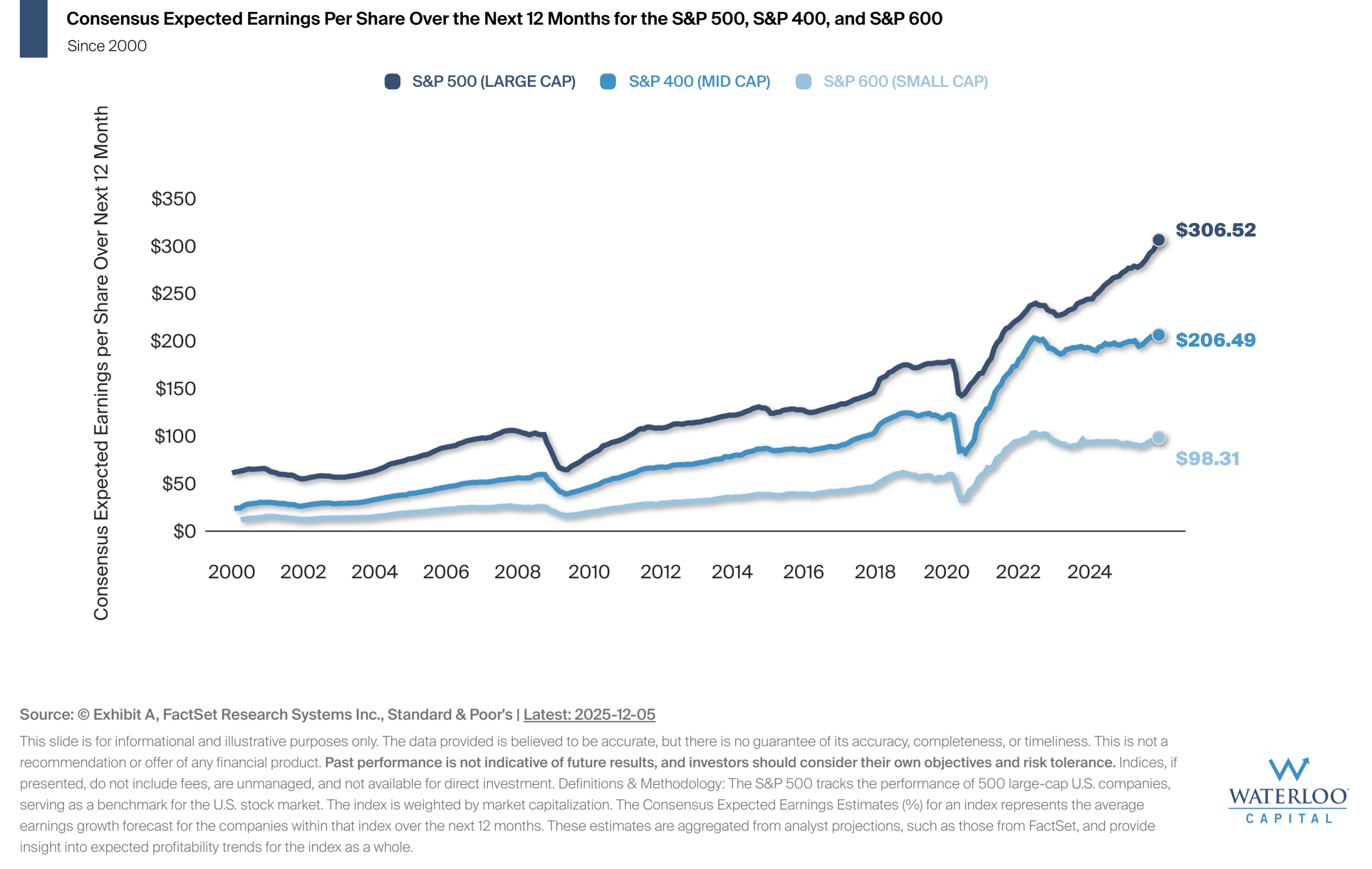

Chart Of the Week – Consensus Expected Earnings Estimates

Forward earnings estimates represent analysts' consensus projections for a company or index's earnings per share (EPS) over[…]

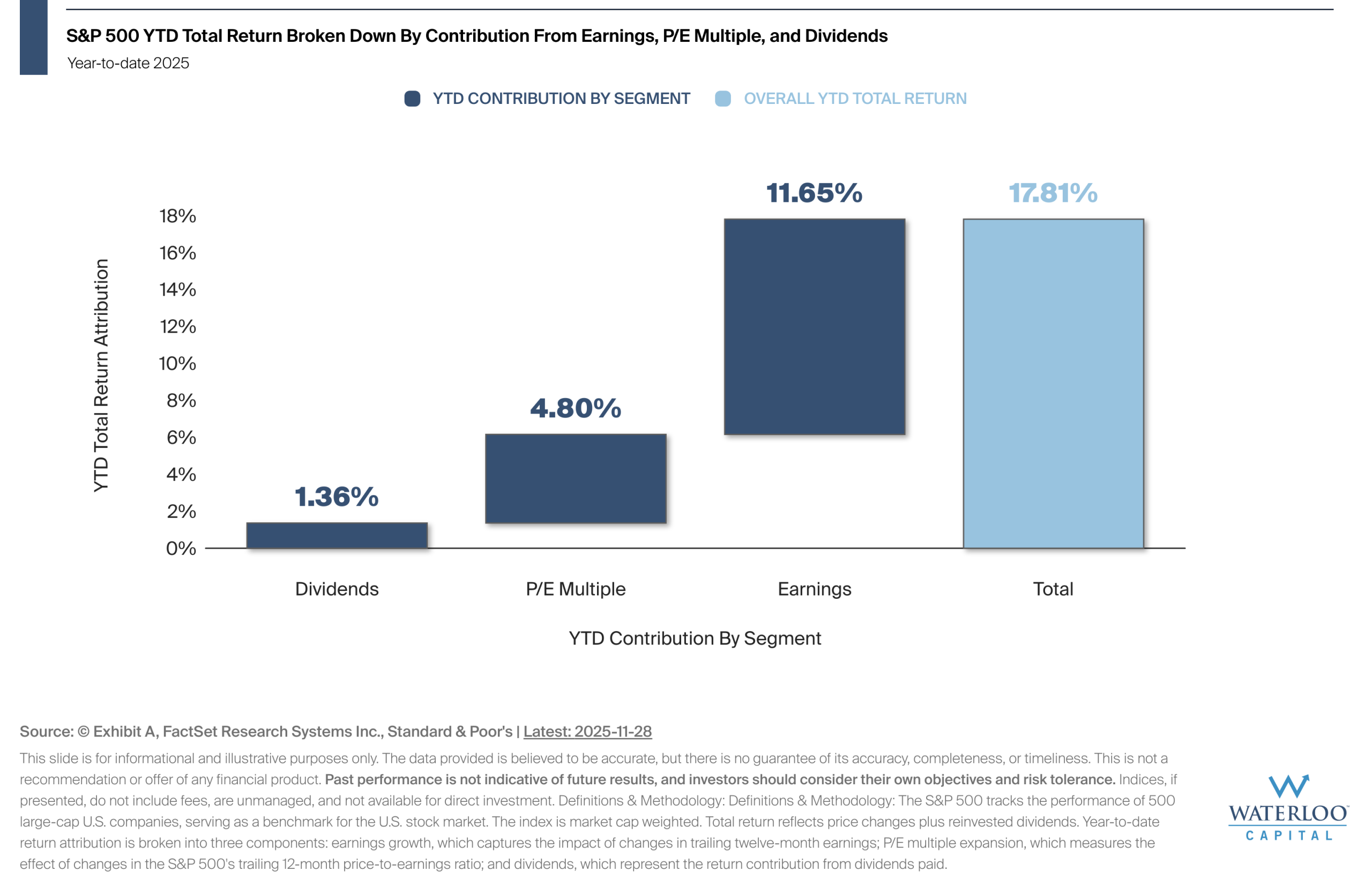

Chart Of the Week – Where Are Equity Returns Coming From In 2025?

The chart shows the S&P 500's total return year-to-date broken down into the contribution from three segments:[…]

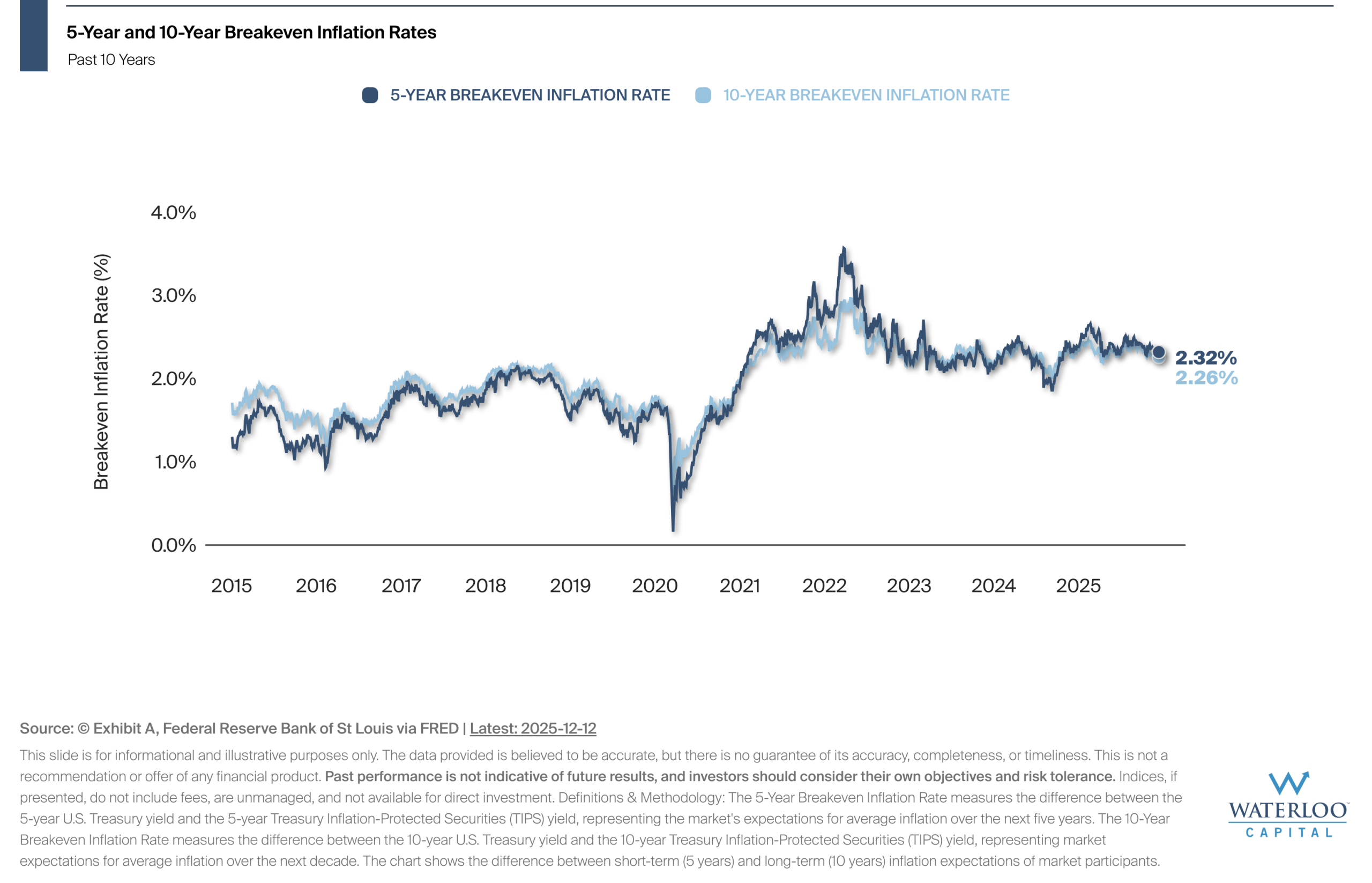

Chart Of the Week – A Peek At Forward Looking Inflation Data

The breakeven inflation rate represents the market's expectation for average annual inflation over a specific time-period, calculated[…]

Chart Of the Week – Gains Increase with Holding Period

S&P 500 data since 1950 demonstrates a clear pattern where extended timeframes have been associated with improved[…]

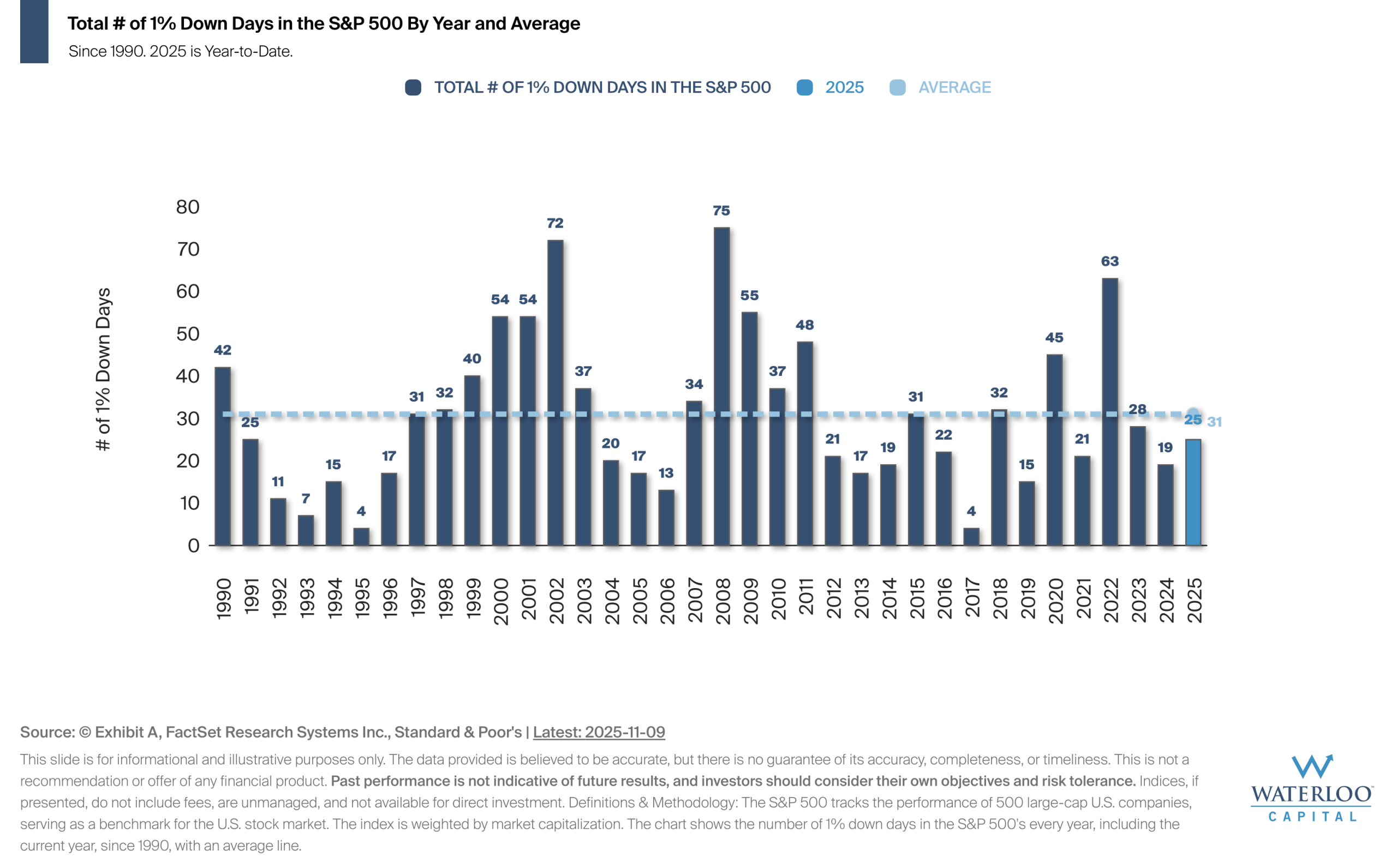

Chart Of the Week – It’s Historically Normal For Large Down Days To Happen

The chart shows that large market declines of 1% or more happen regularly — on average, there[…]

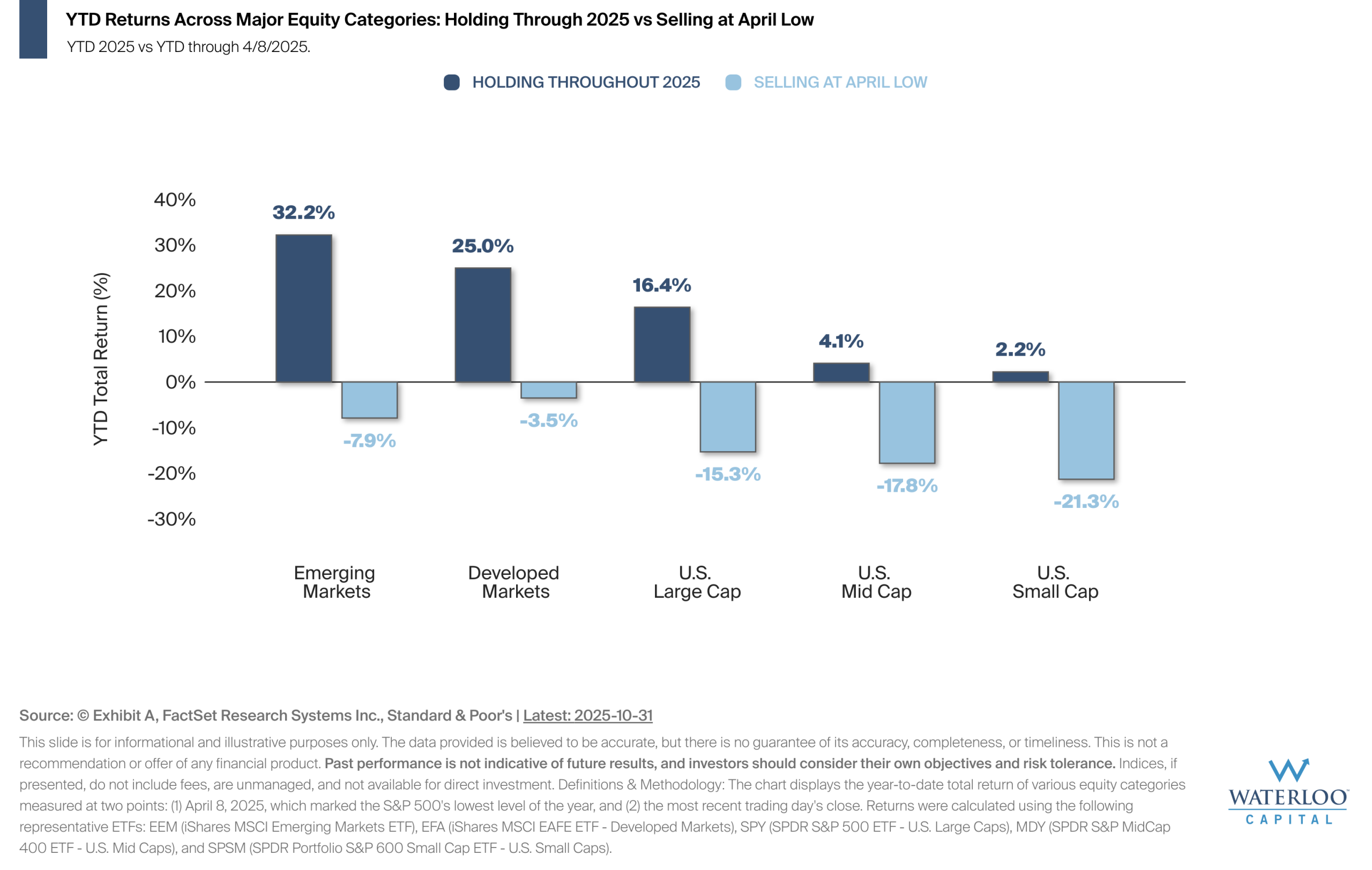

Chart Of the Week – Staying the Course Has Worked Again

The chart compares year-to-date returns across major equity categories for two scenarios: investors who held throughout 2025[…]

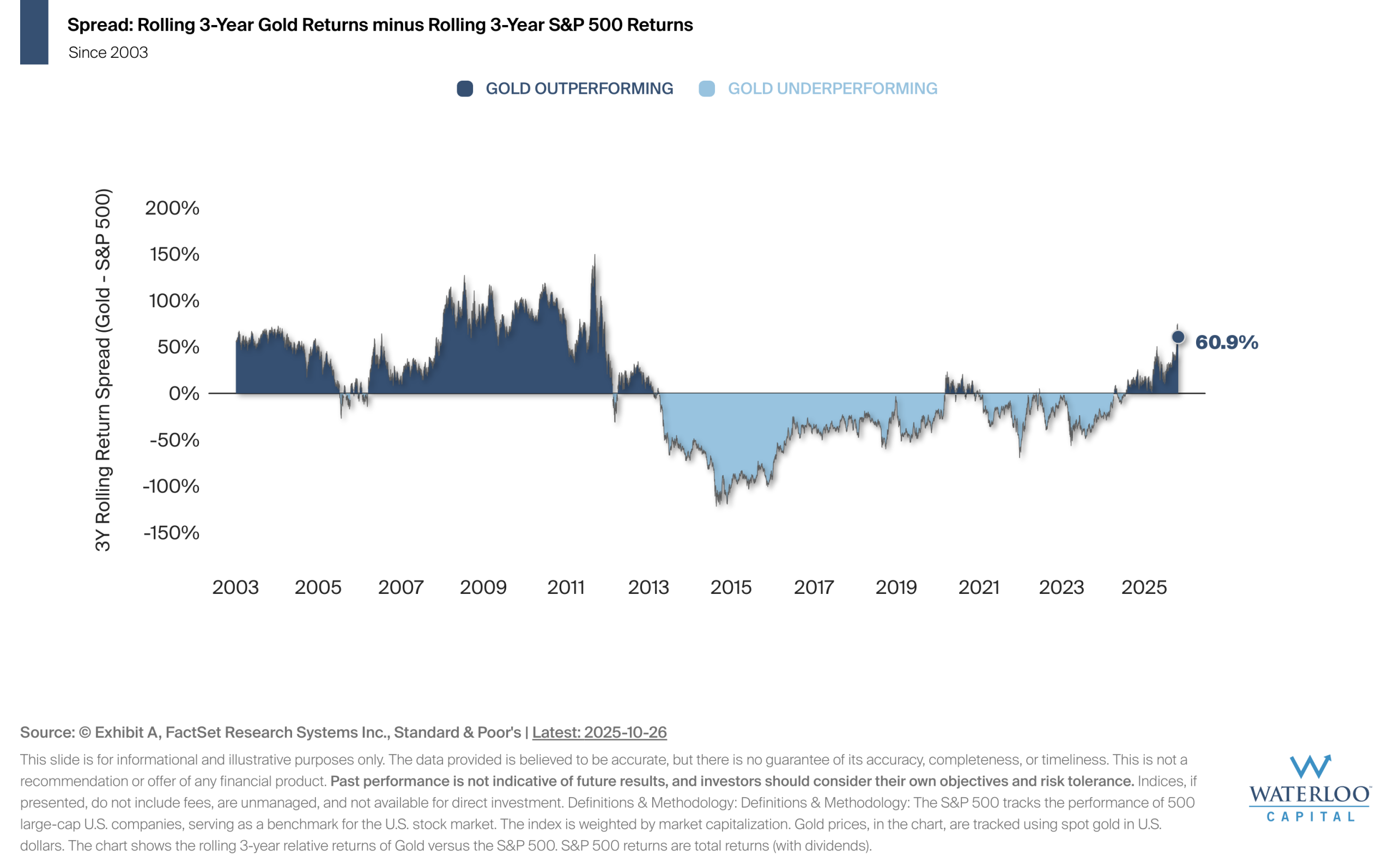

Chart Of the Week – Gold Outperforms in Cycles

The chart illustrates the rolling 3-year performance difference between gold and the S&P 500, showing how leadership[…]

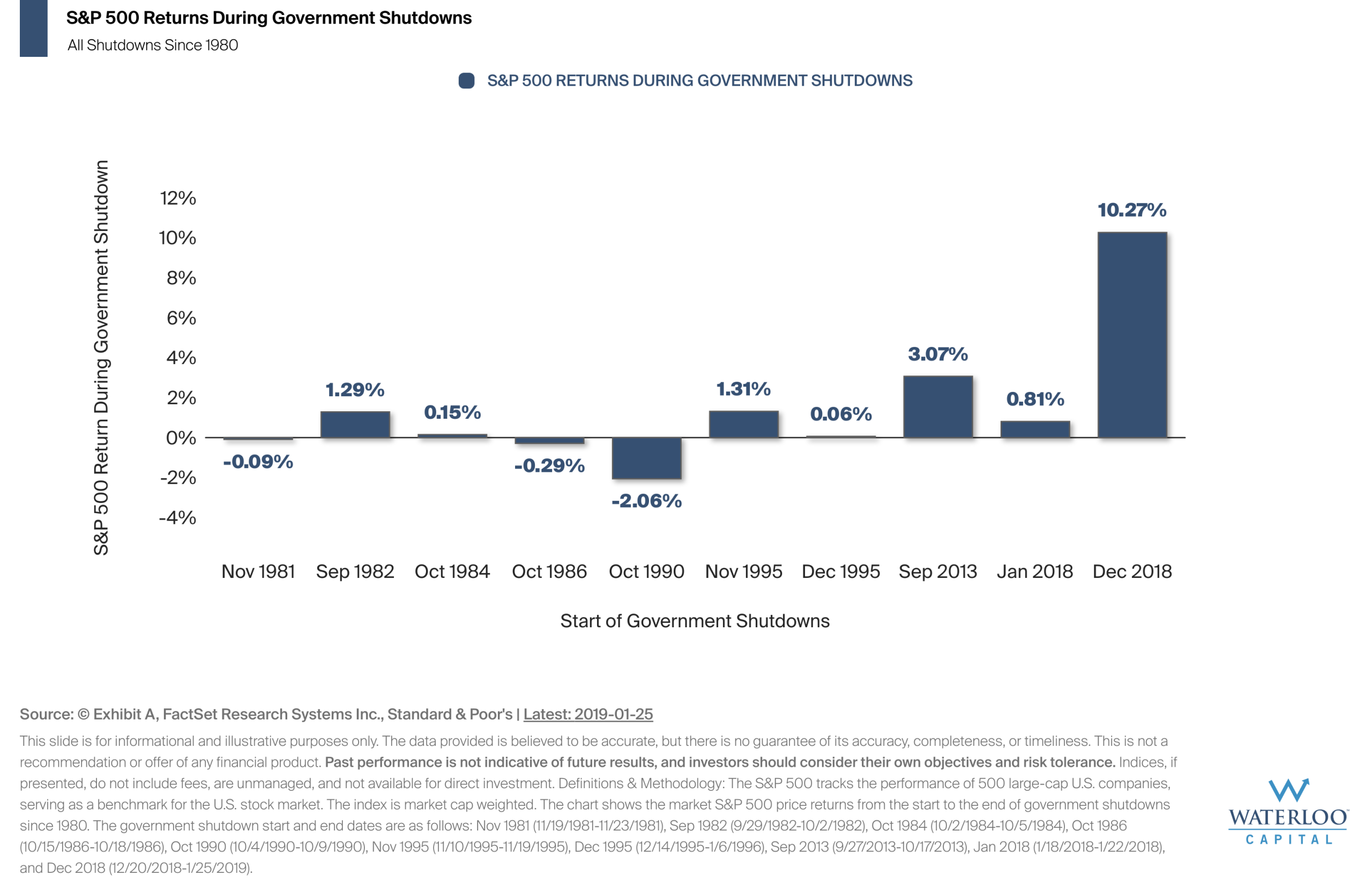

Chart Of the Week – How do Equities Perform During Government Shutdowns?

This chart tracks how the S&P 500 performed during past U.S. government shutdowns.

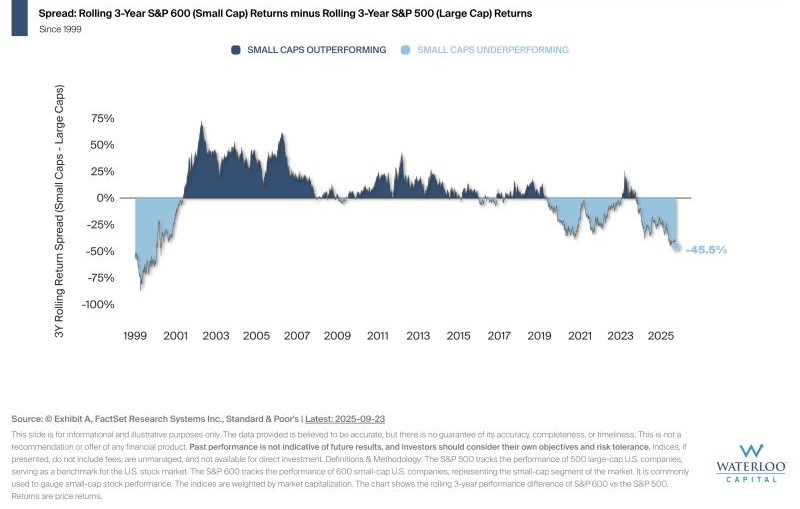

Chart Of the Week – Measuring Cycles of Small Cap vs Large Cap Performance

The chart illustrates the rolling 3-year performance difference between small-cap stocks (S&P 600) and large-cap stocks (S&P[…]