MARKET COMMENTARY

Markets opened the week on shaky ground, as risk sentiment deteriorated across the board. U.S. stocks declined, long-end Treasury bonds slipped, and the dollar weakened, signaling broad-based uncertainty. Meanwhile, gold continued its strong run as a safety trade, climbing another 2% and reinforcing investor caution.

Fueling the unease were headlines from Friday, when administration officials revealed that President Trump is exploring whether he could legally remove Federal Reserve Chair Jerome Powell if re-elected. Such a move would represent a dramatic break from central bank independence and could unleash significant volatility in financial markets.

This week, more eyes are on the Federal Reserve. A full slate of Fed speakers is expected to address both the Powell controversy and ongoing debates over monetary policy. Investors will be parsing every word for signals on the Fed’s bias and whether they remain more concerned about sticky inflation or growing risks to economic momentum.

Technically, the S&P 500 continues to struggle with overhead resistance. The index failed to reclaim the 5,500 mark and remains range-bound near 5,200. Market breadth remains narrow, as leadership is limited and many stocks are still reeling from tariff-related concerns. The path forward remains murky as investors navigate these political risks and macro headwinds.

Newton Model Insights:

Our Newton Model continues to highlight Foreign Developed equities as a relative strength leader. While all asset classes have bounced off recent lows, Growth is beginning to outperform Value. At the sector level, Financials and Utilities are showing the strongest momentum, while Health Care and Consumer Discretionary remain at the bottom of the rankings, struggling to gain traction.

In fixed income, short-term bonds remain the top performer as investors seek safety and flexibility. On the other end, long-duration bonds continue to face headwinds from persistent rate volatility. High Yield and Investment Grade Corporates are also coming under pressure, with rising concerns around future creditworthiness weighing on spreads.

Economic Releases This Week

Monday: U.S. Leading Economic Indicators

Tuesday: Philadelphia Fed President Harker Speaker, Minneapolis Fed President Kashkari Speaks, Richmond Fed President Barkin Speaks

Wednesday: St. Louis Fed President Musalem Speaks, S&P Flash U.S. Services, New Home Sales, Fed Beige Book, Atlanta Fed President Bostic Speaks, Cleveland Fed President Hammack Speaks

Thursday: Initial Jobless Claims, Durable Goods Orders, Existing Home Sales, Minneapolis Fed President Kashkari Speaks

Friday: Consumer Sentiment (Final)

Stories to Start the Week

Ryan Coogler and Michael B. Jordan’s R-rated ‘Sinners‘ takes the box office crown with a solid $45 million.

Pope Francis dies at 88.

President Trump ramped up his pressure campaign on Jerome Powell earlier Monday.

Ryan Gosling to star in a new Star Wars film, set to be released in two years time.

What is Newton?

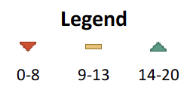

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.