S&P 500: -1.38% DOW: -1.23% NASDAQ: -2.10% 10-YR Yield: 4.05%

What Happened?

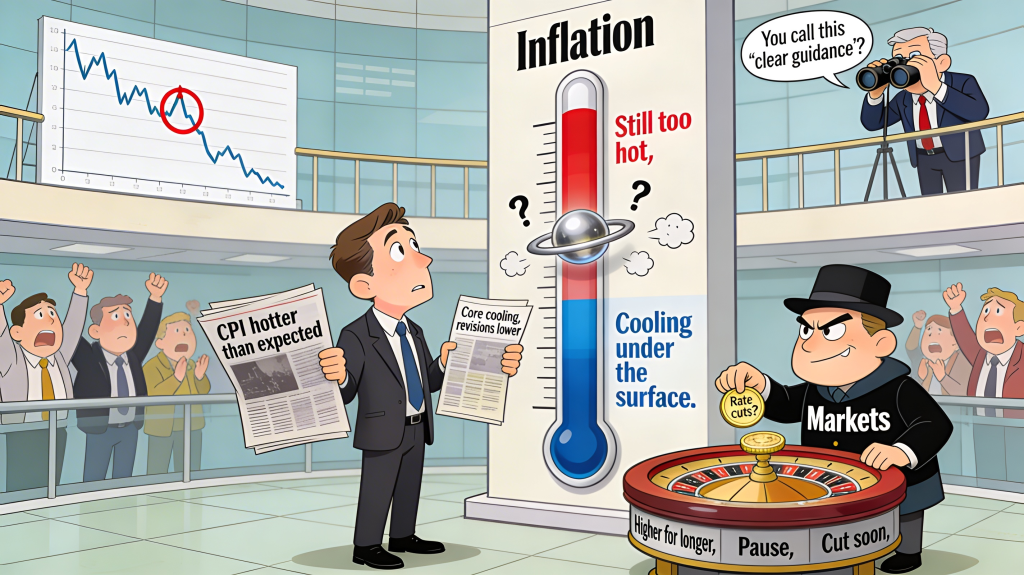

It was a volatile week for markets, with major indexes finishing little changed on Friday but still logging their second consecutive weekly decline. A slightly cooler inflation report offered some reassurance that price pressures are gradually easing, though it failed to ignite much enthusiasm. While hopes for rate cuts remain intact, investors were reluctant to declare victory on inflation just yet. According to CME data, markets continue to price in three rate cuts for 2026.

The bigger story, however, was the growing unease surrounding artificial intelligence and its disruptive effects across industries. What began as pressure in the software sector quickly spread to financials, real estate, trucking, and media, as investors sold off companies perceived as potential AI losers. The divide between perceived winners and losers widened sharply, driving choppy and erratic trading.

A handful of companies delivering solid earnings did manage to buck the trend, but overall sentiment remained cautious as investors reassessed the broader economic outlook in an AI-driven market. Meanwhile, beneath the surface, a more notable move unfolded in fixed income, the 10‑year Treasury yield fell significantly over the week, sparking a meaningful rally in bonds.

What Sweeping Revisions and a Blowout Month Tell Us About the U.S. Job Market

- Nonfarm payrolls rose by 130,000 in January, versus expectations around 70,000 and a revised 48,000 gain in December.

- The unemployment rate edged down to 4.3%, slightly better than forecasts of 4.4%.

- Annual benchmark revisions showed roughly 860,000 to just over 1 million fewer jobs created in the 12 months through March 2025 than previously estimated.

The key takeaway – January’s jobs report showed a paradox the market can’t ignore: a hotter than expected gain of 130,000 payrolls and a dip in unemployment to 4.3%, arriving alongside sweeping revisions that show the prior two years were meaningfully weaker than advertised. On the one hand, the latest monthly print suggests the labor market retains enough underlying momentum, driven largely by healthcare and social assistance hiring, to keep growth positive and delay any imminent cracks in the real economy. On the other hand, benchmark revisions eliminated roughly 860,000 to over 1 million previously reported jobs from the April 2024–March 2025 period, confirming that the “strong” labor market of the last couple of years was materially overstated and has in fact been cooling beneath the surface.

For investors, the signal is that the U.S. labor market is transitioning from a broad, cyclical boom to a narrower, sector driven expansion, robust enough to support risk assets in the near term, but less of a tailwind than headline prints once implied.

For markets, this mix argues for a more prolonged “higher for longer” stance from the Fed rather than an aggressive easing cycle: January’s upside surprise makes it harder to justify near term cuts on the basis of labor weakness, while the large downward revisions temper fears of an overheating economy and help cap longer term inflation expectations. Rates markets are likely to stay choppy as investors reconcile resilient current data with a softer historical trend, keeping the front end sensitive to every incremental labor print and revision. Credit spreads remain historically tight, reflecting confidence that a slower but still growing jobs backdrop reduces near term default risk, while equities may continue to favor services and healthcare oriented earnings over more cyclical, rate sensitive areas like manufacturing and traditional office based sectors. In practice, this report encourages a selective risk on posture: staying invested, but with an emphasis on assets with quality balance sheets.

Inflation Slowed to 2.4% in January, Helped by Lower Gasoline Prices

- Headline CPI rose 0.2% month over month and 2.4% year over year in January, undershooting expectations for a 0.3% and 2.5% increase, respectively.

- The softer-than-expected report helped ease fears of re-accelerating inflation and was broadly interpreted as keeping the Fed on track toward eventual rate cuts.

The key takeaway – Friday ended the week with cooler-than-expected inflation data. The Consumer Price Index was updated for January , showing inflation slowed to 2.4%. This marked the lowest pace of price increases in nearly five years, initially sending some hope to recent weak market activity, though that optimism faded as the day progressed.

After inflation soured during the Covid Pandemic, the Fed aggressively hiked rates to combat it. Many would argue that inflation has still heavily lingered since then, but we may finally begin feeling the impact of those hikes. That said, the Fed will still likely continue its wait-and-see approach over the next several months before continuing the most recent rate cut cycle we’ve seen. The markets, however, have reacted by presuming another rate cut for the year, which moved bond yields down.

Looking closer at the components of CPI and what drove the decline, gasoline and used car prices decreased. Many other categories actually increased compared to a year ago, particularly those heavily weighted in the services industry. Services inflation is still increasing, and economists fear that services inflation will be harder to slow.

Another consideration still afloat is tariff concerns, which have yet to be meaningfully felt, if ever. While the effects of tariffs will likely be a problem in the second half of 2026, that uncertainty remains in the air. As a result, it may take time to fully appreciate inflation moving in the right direction.

From Around the Watercooler

AI researchers are sounding the alarm on their way out the door

U.S. Smuggled Thousands of Starlink Terminals Into Iran After Protest Crackdown

Trump Administration to End Immigration-Enforcement Surge in Minnesota

Spy agency says Kim Jong Un’s daughter is close to being designated North Korea’s future leader

Disclousure:

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This newsletter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Waterloo Capital to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. Reliance upon information in this letter is at sole discretion of the reader. Please consult with a Waterloo Capital financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this newsletter aligns with your overall investment goals, objectives and tolerance for risk. Additional information about Waterloo Capital is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 133705. Waterloo Capital is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.