Market Commentary

Stocks and bonds continued their decline as the week kicked off, following Friday’s surprising blowout jobs report.

Investors are recalibrating their expectations, with markets now pricing in less than 30 basis points of Fed rate cuts for all of 2025. This shift has pushed the 10-year Treasury yield to a 14-month high, while the 30-year yield hovers just below the significant 5% threshold. Stabilizing yields will be crucial before equity markets can regain any meaningful momentum.

On the commodities front, oil prices surged to a five-month high after the U.S. announced its most aggressive sanctions yet on Russia’s oil trade. These measures are expected to reduce the global crude surplus, adding upward pressure on prices. The International Energy Agency had predicted a surplus of 1 million barrels per day this year.

This week promises more market volatility as economic data drives investor sentiment about the Fed’s next moves. All eyes will be on Wednesday’s Consumer Price Index (CPI) report, which offers an update on inflation. While inflation has eased from its peak, it remains well above the Fed’s target and is ticking higher. Expectations call for a 2.9% year-over-year rise, up from 2.7% last month. We also will get a better read on the consumer and the economy with retail sales on Thursday. Analysts expect a slight uptick to 0.4% year-over-year from 0.7% last month.

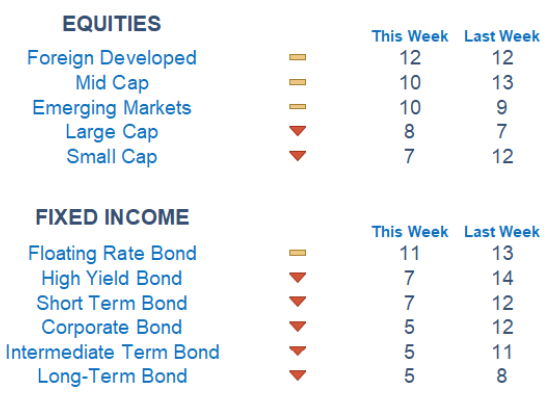

The S&P 500 gave up its year-to-date gains last week and has opened around the crucial 5,790 support level. This is an important psychological level that could attract buyers. Turning to our Newton Model, the softening across styles and sectors continued. Last week, Energy emerged as the strongest-performing sector, followed closely by Communications and that trend continued this week. Interest rate-sensitive sectors like Real Estate and Utilities lagged. In fixed income, we still see relative strength at the front end of the curve and away from interest rate sensitivity.

Economic Releases This Week

Monday: Monthly U.S Federal Budget

Tuesday: NFIB Optimism Index, Producer Price Index, Kansas City Fed President Speaks, Fed Beige Book

Wednesday: Consumer Price Index, Empire State Manufacturing Survey, Richmond/New York/Chicago Fed President’s Speak

Thursday: Initial Jobless Claims, U.S. Retail Sales, Home Builder Confidence Index

Friday: Housing Starts, Industrial Production, Capacity Utilization

Stories to Start the Week

Santa Ana winds are expected to persist over the next three days across Los Angeles and Ventura counties. The death toll rose to 24.

A January 19th deadline looms for a TikTok sale or else face a U.S. ban.

Office vacancies hit a new high last year, with 20% of office space in the country’s top 50 metro areas empty.

Bill Ackman’s Pershing Square is forming a new entity. to merge with real estate developer Howard Hughes Holdings

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.