While it may feel safer to wait until things “look better”, history shows that the market often recovers while fundamentals still appear weak.

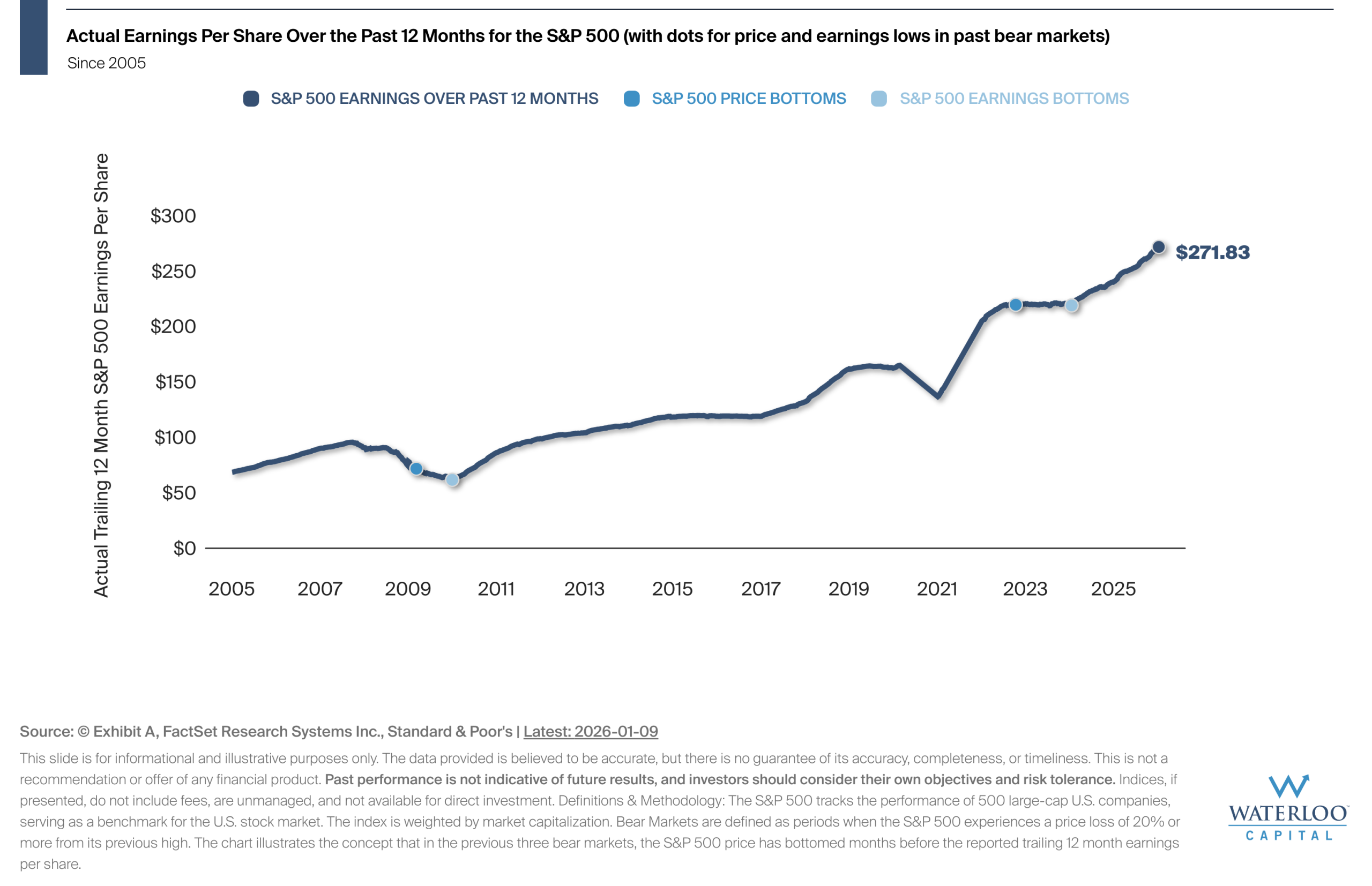

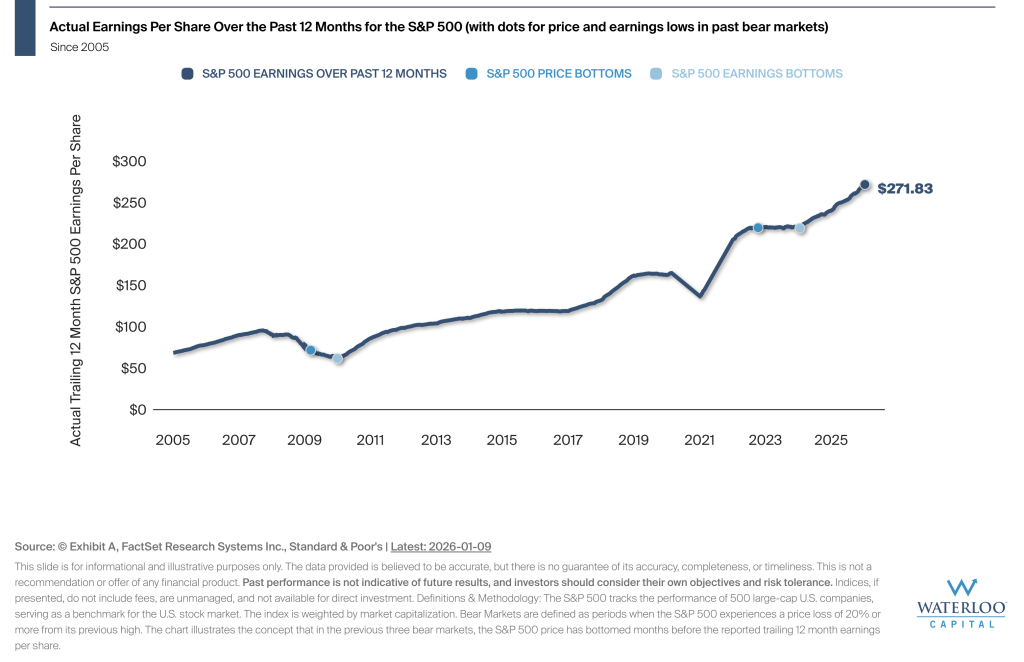

In 2009, 2020, and 2022, S&P 500 price bottomed months before earnings hit their lows. This pattern is consistent: the market anticipates recovery and begins to rebound even as reported earnings continue to fall. The result? Waiting for earnings to “catch up” has meant buying back in at much higher levels.

Looking at today’s market environment, many investors are still sitting on the sidelines, waiting for the economy or earnings to “look better” before getting back in. But history suggests that by the time things feel safe, markets have already moved.