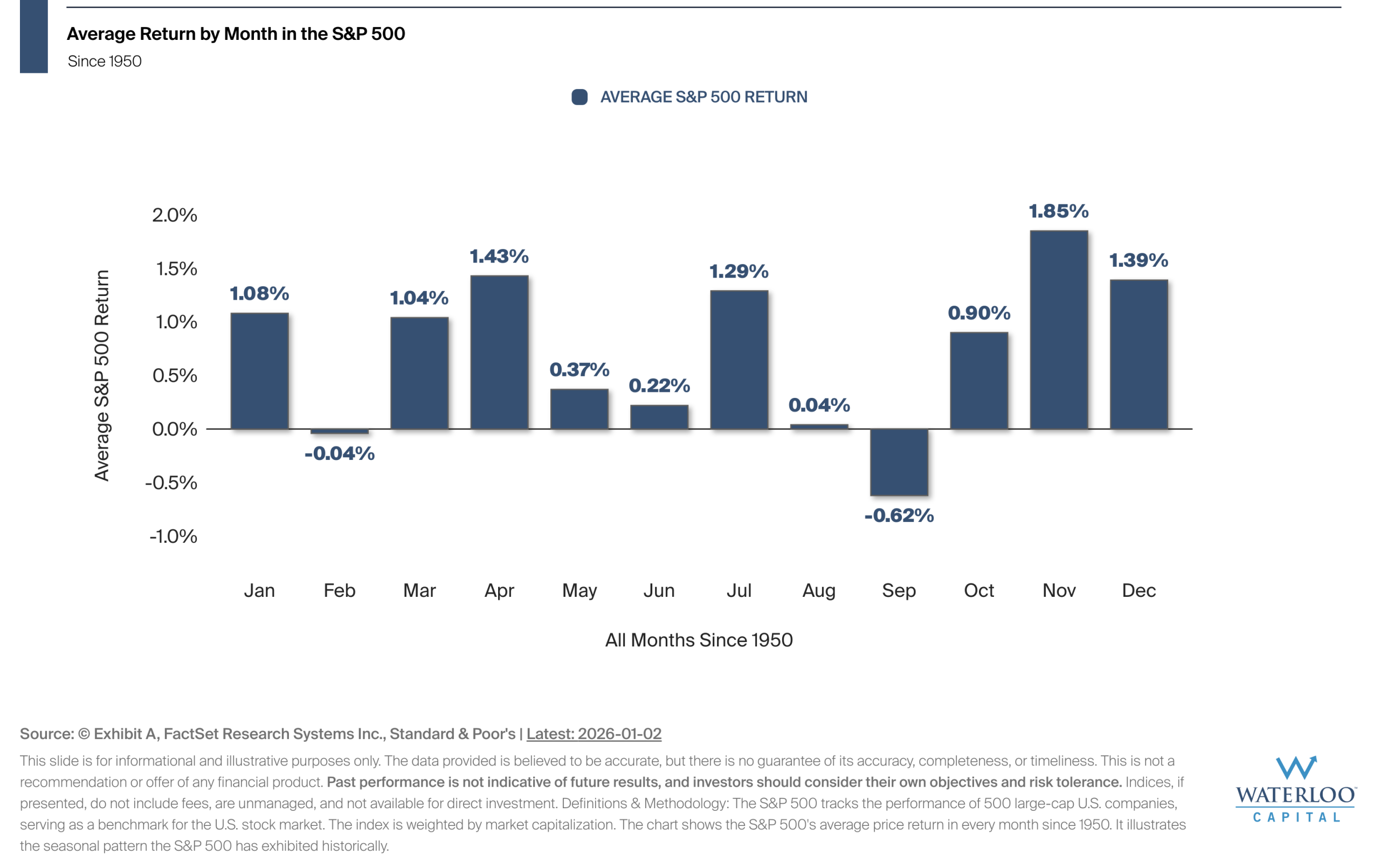

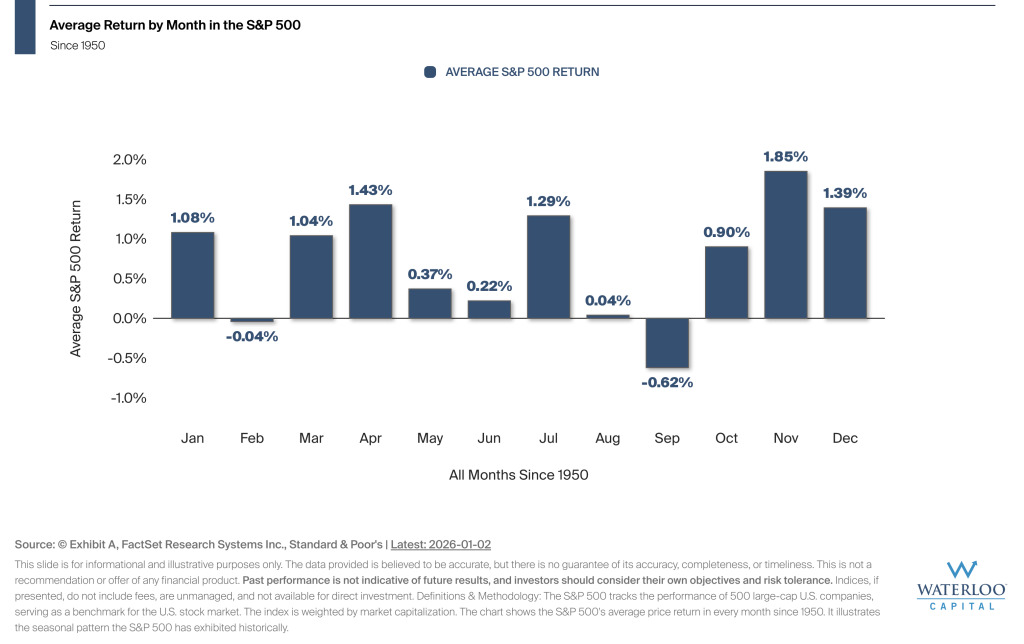

Seasonality refers to recurring trends in market performance during specific times of the year. The S&P 500 has historically shown seasonal patterns driven by factors such as earnings seasons, macroeconomic events, and investor behavior. However, these trends may vary each year and are not guaranteed.

It’s important to remember that market conditions and external factors can influence results, and past performance does not guarantee future returns.

Seasonality provides historical context for understanding market patterns throughout different months of the year. However, seasonal patterns should be viewed as historical observations rather than predictive indicators, as market conditions and external factors can influence actual results each year.