S&P 500: -0.35% DOW: -0.53% NASDAQ: -0.06% 10-YR Yield: 4.23%

What Happened?

A big freeze across the U.S. is expected this weekend and, with it, a chill on the steady gains investors have grown used to in recent months. All three major indexes finished the week lower, still nursing bruises from an earlier drawdown triggered by President Trump’s threat to ratchet up tariffs on NATO partners after they pushed back against U.S. moves to assert control over Greenland. Markets sold off as traders tried to handicap how far the White House was willing to take the confrontation, then clawed back some ground as the rhetoric softened, leaving the tape choppy and directionless into the close.

Beneath those headlines, though, the “great rotation” theme stayed very much alive. Money continues to leak out of the crowded Magnificent Seven and other megacap tech names and into smaller, more domestically focused companies, with the Russell 2000 ripping to new all‑time highs even as the S&P 500 and Nasdaq slipped. That divergence has been one of the defining features of this year’s market, rewarding investors who were willing to move down the market‑cap spectrum after years of mega‑cap dominance.

At the same time, the global buyer base is quietly rebalancing its view of what constitutes a safe asset. Between tariff volleys, Greenland brinkmanship, and lingering questions about U.S. fiscal policy, more sovereign and institutional investors are inching away from U.S. debt at the margin and parking additional capital in traditional havens like gold. The result is a market that looks calm in the headline indexes but is reshuffling under the surface—capital rotating across sectors, sizes, and even countries as investors try to stay ahead of both geopolitics and the economic cycle.

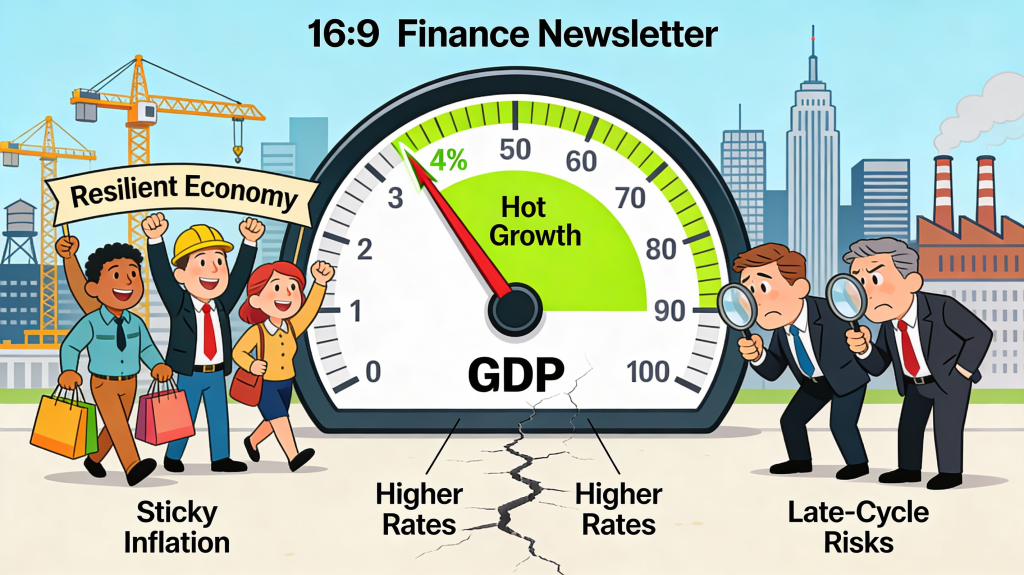

Updated GDP Data Confirms U.S. Economy Remains Robust

- Q3 2025 gross-domestic product grew 4.4% annualized.

- The government’s data-publication efforts are running behind schedule after the federal shutdown.

The key takeaway – Q3 2025 GDP came in hot this week, with the first estimate showing annualized growth north of 4%, easily topping economists’ expectations and reinforcing the narrative of a still‑resilient U.S. economy. From the optimistic perspective, the report suggests that, even after a year of tariff headlines, tighter financial conditions, and constant chatter about an impending slowdown, aggregate activity is still expanding at a brisk clip. Consumer spending remains the central engine, supported by low unemployment, rising real wages, and relatively healthy household balance sheets built up over the past several years. Business investment has held up better than feared, particularly in areas like technology, automation, and reshoring‑related projects, while government and infrastructure spending continue to provide an additional tailwind. Through that lens, the GDP release says the U.S. has absorbed a lot of macro noise without stalling out, which is exactly the kind of backdrop that keeps the soft‑landing story alive for risk assets.

The more skeptical view is that this strong top‑line GDP number can hide mounting pressure underneath the surface. A meaningful slice of the growth may be coming from government outlays, inventory rebuilding, and one‑off adjustments to tariffs and supply chains rather than sustainable, productivity‑driven private demand. Late‑cycle stress is already evident in interest‑rate‑sensitive sectors such as commercial real estate, lower‑quality credit, and certain consumer finance segments, none of which is fully captured in a single quarter’s print. Tariffs and supply‑chain repositioning can temporarily pull forward activity as firms rush orders and reconfigure sourcing, while quietly compressing margins and chipping away at future demand. If growth stays this strong while inflation proves sticky, the Fed has less room to cut aggressively, which could keep real borrowing costs elevated and gradually pressure valuations, particularly in the most rate‑sensitive corners of the market.

The West Stepped Back From the Brink. But Europe’s Distrust of America Lingers.

- Equities sell off on tariff and invasion talk, then rebound when the White House walks the rhetoric back.

- As allies talk “strategic autonomy,” investors have to price a higher, more persistent geopolitical risk premium into U.S. assets.

The key takeaway – The infamous TACO (Trump Always Chickens Out) trade has reappeared on traders’ screens this week as world leaders gather in Davos, Switzerland, to talk global commerce at the World Economic Forum. The basic pattern is familiar: bold threats from the White House on tariffs and even saber‑rattling over Greenland, followed by sudden reversals or softening language once markets, allies, or domestic politics begin to push back. In between, markets are left to act as the middleman between geopolitics and economic reality, selling off when tariff fears on key trading partners spike and then snapping back when the President signals that the harshest measures are really just part of the negotiation theater.

What makes this round of the TACO trade more unsettling is the broader geopolitical backdrop. Floating invasion talk around Greenland and repeatedly using tariff threats as leverage comes at a time when many allies, NATO partners in particular, are already reassessing their security commitments and trade ties with Washington. Several European governments have openly pushed back on the tariff threats tied to the Greenland dispute, framing them as an attack on sovereignty rather than a routine trade skirmish, and EU institutions have already slowed work on parts of the transatlantic trade agenda in response. For investors, that matters because when allies start to question the reliability of the U.S. as a security partner, they also begin looking for ways to diversify away from the U.S. as a supplier, customer, and destination for long‑term capital. The more NATO capitals talk about “strategic autonomy” and reducing vulnerability to U.S. policy swings, the more global capital allocators have to factor in a higher, more persistent geopolitical risk premium on U.S. assets rather than treating each TACO episode as a short‑term trading opportunity.

From Around the Watercooler

TikTok lands $14B deal to avoid US ban – POLITICO

Intel’s stock meltdown risks eroding Trump-endorsed comeback

Japan’s Nikkei slumps as yen rallies, machine orders fall; Greenland woes weigh

US energy sector braces for winter storm as crude and natural gas output fall | Reuters