Market Commentary

Stocks found more footing to start the week while the dollar fell by the most since November 2023.

With just two weeks remaining before a new U.S. presidency begins, the dollar slipped nearly 1% as traders weighed reports that the Trump team may scale back its tariff plans. The dollar has been buoyed in recent months by expectations of aggressive tariffs targeting the U.S.’s major trading partners, but the prospect of a narrower approach has softened that momentum.

Meanwhile, U.S. stocks rallied to start the week, driven by gains in megacap technology stocks. This follows a period of weakness for major indexes, weighed down by diminished hopes for rate cuts and concerns over potential economic and inflation shocks. The bond market has also felt the heat, with the 10-year Treasury yield climbing 50 basis points since December to 4.6%. These elevated yields could present a headwind for equities in the first half of the year.

After a slow week of economic data last week, this week is chock-full of it. Today, we’ll get a glimpse into the health of the service side of the economy, with expectations pointing to a resilient consumer. Midweek, all eyes will be on the Federal Reserve as the minutes from their early December meeting are released, providing better insight into their decision to slow the rate of cuts. Finally, the week wraps up with a crucial look at the labor market. Expectations suggest job gains of 155,000, down from last month’s 227,000, with the unemployment rate anticipated to hold steady at 4.2%.

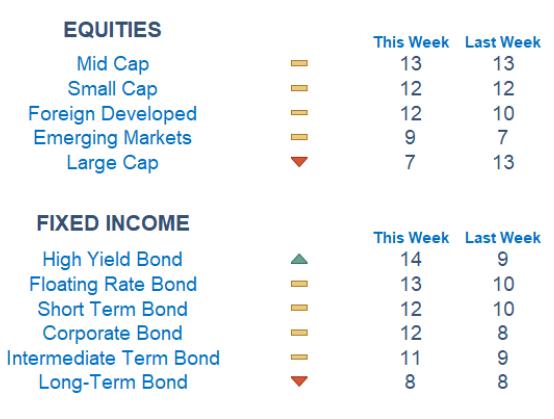

Turning to our Newton Model, we’re noticing some softening in large-cap stocks. For the first time in a while, Energy is emerging as the strongest-performing sector, followed closely by Communications and Financials. Meanwhile, Materials, Real Estate, and Technology are lagging behind. In fixed income, we are still seeing relative strength at the front end of the curve and away from interest rate sensitivity.

Economic Releases This Week

Monday: Factory Orders

Tuesday: Richmond Fed President Tom Barkin Speaks, ISM Services, Job Openings

Wednesday: ADP Employment, Minutes of Fed’s December FOMC Meeting, Consumer Credit

Thursday: Initial Jobless Claims, Wholesale Inventories (Markets closed to honor Jimmy Carter)

Friday: US Employment Report

Stories to Start the Week

Prime Minister Justin Trudeau is holding a news conference this morning to announce he is stepping down as Liberal leader.

Yesterday, President Biden signed a bill to increase Social Security benefits to millions of public workers.

US Steel and Nippon Steel sued the Biden administration over their blocked merger.

New York implemented its controversial Manhattan congestion pricing plan today, the first such program in the US.

Ski patrol workers at Park City in Utah are entering the second week of a strike which has brought the mountain to a near standstill during its busiest time of the year.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.