Market Commentary

The so-called “Santa Rally” fell short to start off the week, with markets ending 2024 on a cautious note.

Major indexes extended Friday’s losses due to profit-taking following the Fed’s “hawkish cut,” which dampened expectations for 2025 interest rate reductions. Although there was an initial recovery early last week, it proved short-lived. Concerns also linger in the fixed income market as the 10-year Treasury yield edges closer to its 2024 high of 4.73%.

Investors are closely monitoring S&P 500 support levels near 5,940 and upcoming economic data for clues on consumer health and housing market trends. Key attention this week is on the ISM Manufacturing Index, expected to dip slightly to 48.1% from November’s 48.4%, serving as an important gauge of economic output.

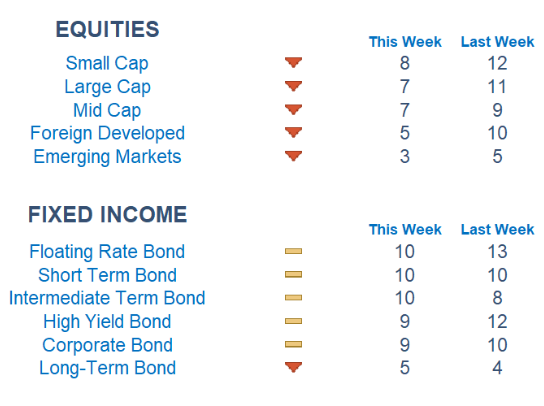

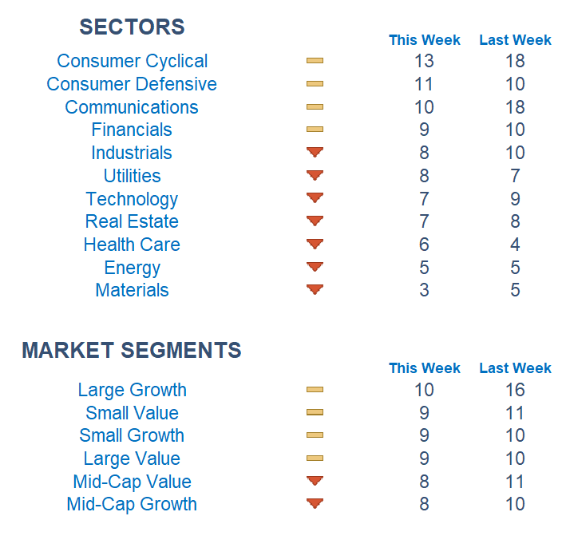

According our Newton Model, consumer discretionary, technology, and health care are the leading sectors, while utilities, materials, and energy continue to weaken. Large growth stocks are still showing a slight edge over their counterparts, with midcap and small-cap equities rebounding. In fixed income, short-term debt leads.

Happy New Year from the team!

Economic Releases This Week

Monday: Pending Home Sales

Tuesday: S&P Case-Shiller Home Price Index

Wednesday: New Year’s Holiday, Market Closed

Thursday: Initial Jobless Claims

Friday: ISM Manufacturing, Richmond Fed President Barkin Speaks

Stories to Start the Week

Just 2 people survived South Korea’s worst plane crash in 20 years.

NYSE to close on January 9th to honor late former President Jimmy Carter.

Trump gives U.S. House Speaker Johnson “complete and total endorsement”

Netflix sets streaming record with Christmas Day NFL games.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.