The stock market stumbled into Monday’s session on unsure footing following last week’s notable shift away from recent top performers.

This Week on Wall Street - Week of July 22nd

Market Commentary

The stock market stumbled into Monday’s session on unsure footing following last week’s notable shift away from recent top performers. However, those battered down stocks showed some resiliency Monday, recovering some of the losses.

Earnings season is well underway, and this week, 25% of the S&P 500 will report their second-quarter performance, including major names like Google, Tesla, and Coca-Cola. So far, this earnings cycle has produced solid results, with an above average number of companies beating earnings expectations, albeit by a smaller margin than usual. Earnings growth for companies reporting so far has been strong, a positive indicator for upcoming reports. However, as always, the performance of a few key companies, such as Nvidia, Google, and Tesla, will likely dictate the market's trajectory, so we wait patiently for their results.

While a very backward-looking metric, investors look forward to the GDP figure to gauge the economy's health. Forecasts suggest an annualized growth rate of 1.9% for the quarter, which is below average but enough to sustain the economy’s current steady state. While the GDP report looks backward, the S&P PMIs will provide investors with current economic data, offering insights into the economy's condition and potential future performance. The PCE release is expected to have the most significant market impact, as investors hope the Fed’s preferred inflation gauge aligns with the CPI, providing the central bank with justification for potential rate cuts later this year.

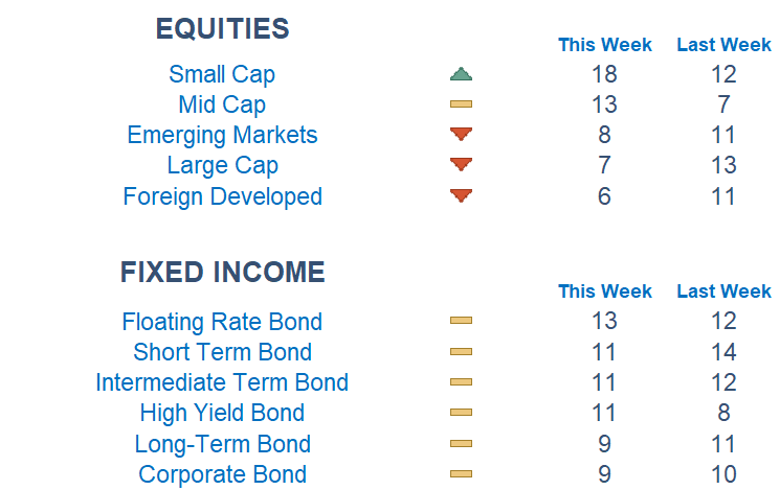

The last few days have shown one of the more drastic short-term rotations from our Newton Model in some time. Across the board, we see a broadening out and rotation in the equity market as mid and small-cap stocks have made a resurgence while the large-cap winners have dropped. This rotation is also seen in sectors that have been underappreciated, such as Financials, Real Estate, and Industrials. Before confirming a new trend, we will need to see sustained follow-through on this rotation.

Economic Releases This Week

Monday: None

Tuesday: Existing Home Sales, S&P Service PMI, S&P Manufacturing PMI

Wednesday: New Home Sales, Fed Gov

Thursday: Q2 GDP Report, Initial Jobless Claims

Friday: PCE Index, Consumer Sentiment

Stories to Start the Week

CrowdStrike shares struggle as they continued to help clients across industries recover from an outage that took millions of Microsoft Windows devices offline

The opening ceremony for the 2024 Paris Olympics will take place on the Seine on Friday and includes a four-hour visual show

Xander Schauffele won the British Open, his second golf major of the year. American golfers have swept all four majors this year for the first time since 1982

Delta Air Lines canceled over 4,600 flights from Friday through Sunday, more than any other carrier following the CrowdStrike outage

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.